EXHIBIT 99.1

Published on June 2, 2009

1

NAREIT Investor Forum

Wednesday, June 3, 2009

and

Thursday, June 4, 2009

2

• Business Overview

• Summary of 1st Quarter

2009

• Summary of 2008 Financial Results

• Development Update

• Financial Strategies

• 2009 Challenges

• History of Consistent Success & Investor Reward

3

Business Overview

4

4

State of the Industry

Tanger - Myrtle Beach - Hwy 17, SC

5

5

Tanger - Myrtle Beach - Hwy 501, NC

Growth Prospects

6

1st Quarter 2009 Highlights

7

§ 11.9% increase in FFO per share to $0.66 from $0.59 for 1Q08.

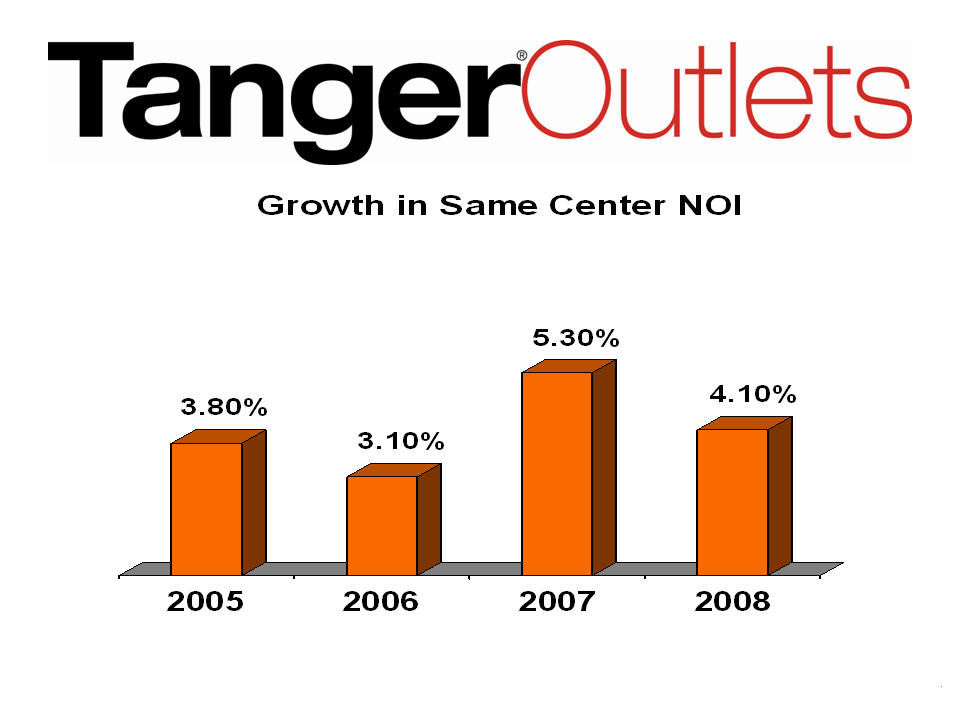

§ 2.4% increase in same center NOI.

§ Quarter end occupancy of 93.5% for stabilized,

wholly-owned properties.

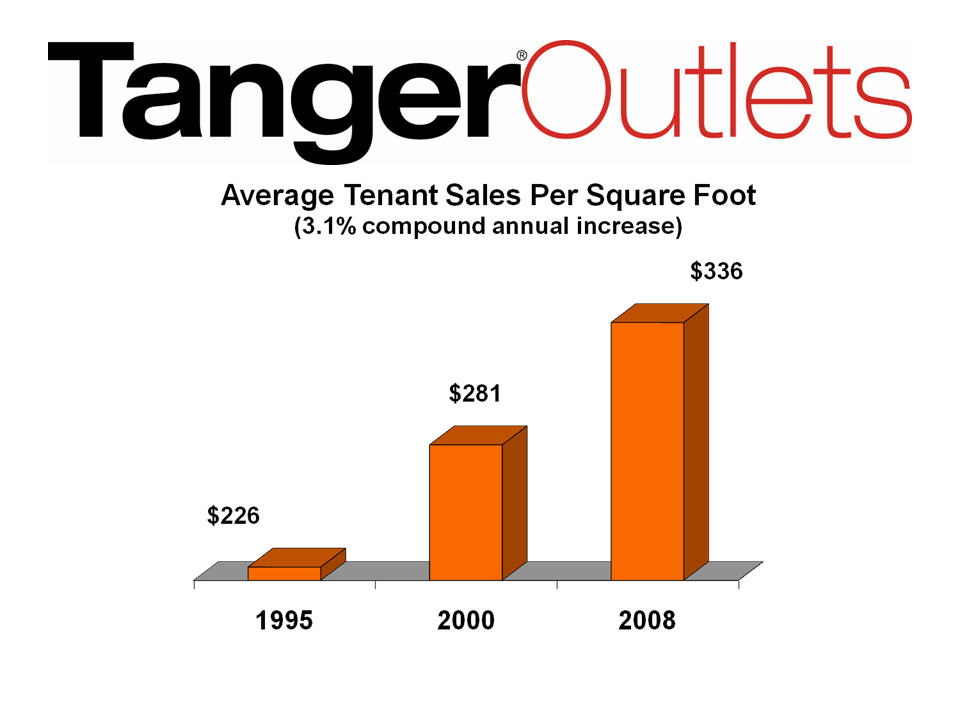

§ Comparable tenant sales decreased 3.2% to $338

per square foot.

§ Completed an exchange offer on May 8, 2009

resulting in the retirement of

$142.3 million of Exchangeable Notes and the issuance of approximately 4.9

million common shares. This represents 95.2% of the Exchangeable Notes that

have an initial put date of August 2011. For each $1,000 Note tendered, holders

received 34.2079 common shares.

$142.3 million of Exchangeable Notes and the issuance of approximately 4.9

million common shares. This represents 95.2% of the Exchangeable Notes that

have an initial put date of August 2011. For each $1,000 Note tendered, holders

received 34.2079 common shares.

Impact of Exchange Offer

(Debt to Equity Conversion)

(Debt to Equity Conversion)

8

Key Financial Ratios as of March 31, 2009:

Actual

Pro-forma*

Limit

Key Bond Covenants (based on GAAP consolidation)

Total debt to adjusted total assets

53%

44%

60%

Secured debt to adjusted total assets

2%

2%

40%

Unencumbered assets to unsecured debt

186%

223%

135%

Interest coverage

3.65 x

4.55 x

2.00 x

* Reflects the reduction in debt that resulted from the exchange offer completed May 8, 2009.

9

9

8.4%

4.7%

3.3%

3.3%

3.2%

2.9%

2.8%

2.5%

2.3%

64.4%

The Gap

PVH

Nike

Adidas

VF

Liz

Dress

Barn

Barn

Carters

Polo

Other

Retailers

Note: As of March 31, 2009

Portfolio Diversification

2.2%

Jones

Retail

Corp

Retail

Corp

10

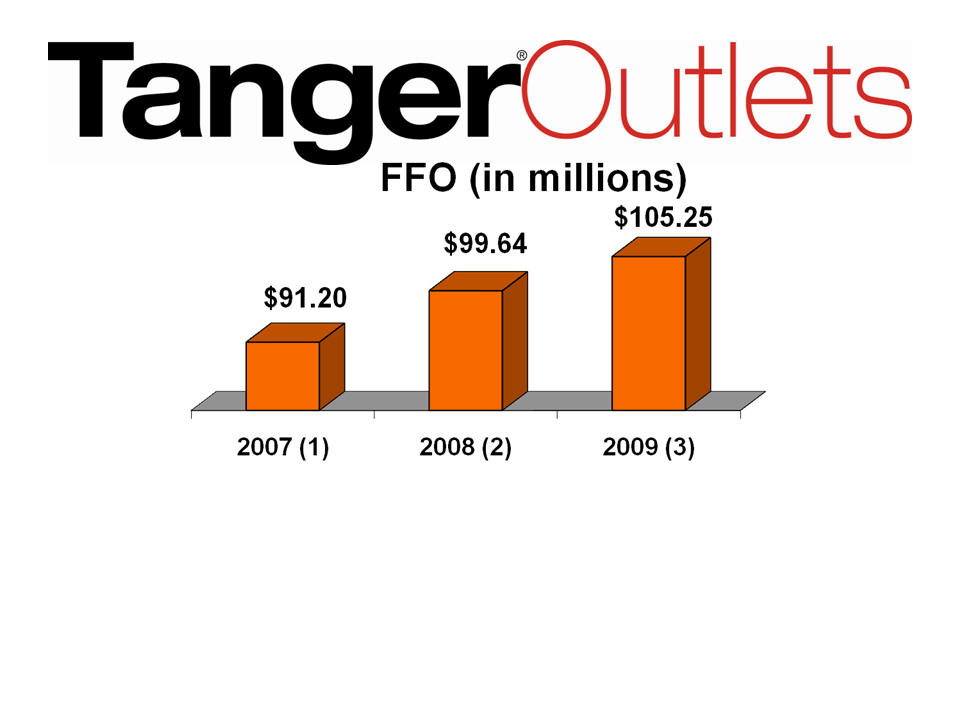

5.6%

Increase

(1) After FSP 14-1 restatement of interest expense related to 2026 Exchangeable Notes.

(2) Excludes $2.2 million termination rents, $3.3 million abandonment of due diligence costs,

$8.9 million charge for settlement of T-locks, $406,000 debt prepayment premium. Reduced to

reflect accounting change requiring recognition of interest expense on convertible debt at

market rate, rather than the lower, stated rate.

$8.9 million charge for settlement of T-locks, $406,000 debt prepayment premium. Reduced to

reflect accounting change requiring recognition of interest expense on convertible debt at

market rate, rather than the lower, stated rate.

(3) Represents the midpoint of $2.73 to $2.83 guidance range before adjustment for the dilutive

effect of the exchange offer completed on 05/08/09. Excludes a gain on debt extinguishment of

approximately $10.8 million to be recognized during the second quarter.

effect of the exchange offer completed on 05/08/09. Excludes a gain on debt extinguishment of

approximately $10.8 million to be recognized during the second quarter.

11

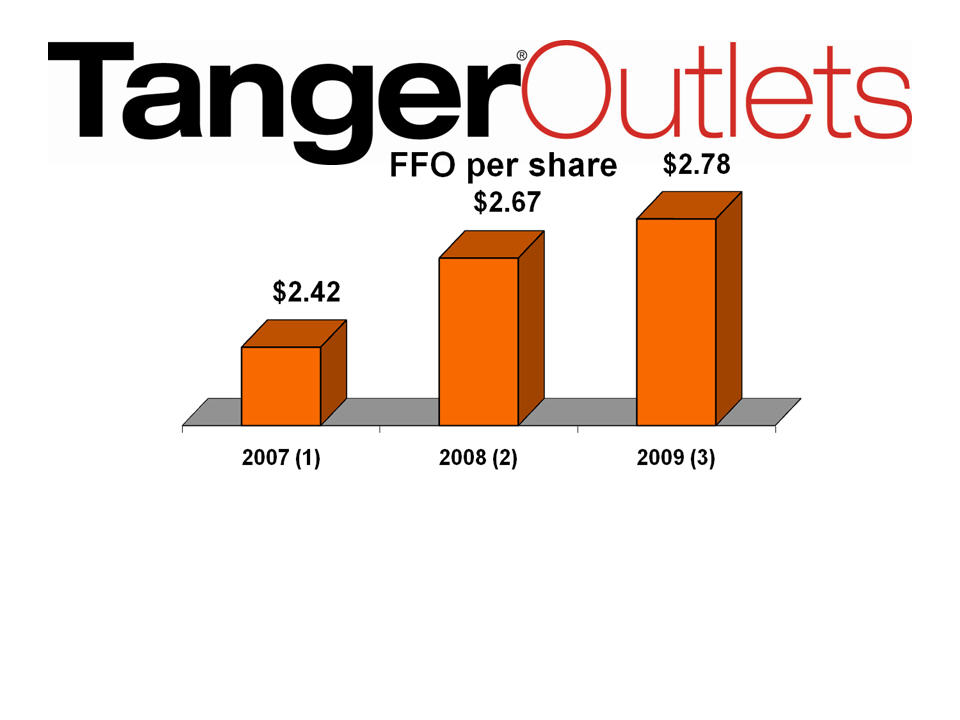

4.1%

Increase

Increase

(1) After FSP 14-1 restatement of interest expense related to 2026 Exchangeable Notes.

(2) Excludes $2.2 million termination rents, $3.3 million abandonment of due diligence costs,

$8.9 million charge for settlement of T-locks, $406,000 debt prepayment premium. Reduced to

reflect accounting change requiring recognition of interest expense on convertible debt at market

rate, rather than the lower, state rate.

$8.9 million charge for settlement of T-locks, $406,000 debt prepayment premium. Reduced to

reflect accounting change requiring recognition of interest expense on convertible debt at market

rate, rather than the lower, state rate.

(3) Represents the midpoint of $2.73 to $2.83 guidance range before adjustment for the dilutive

effect of the exchange offer completed on 05/08/09. Excludes a gain on debt extinguishment of

approximately $10.8 million to be recognized during the second quarter.

effect of the exchange offer completed on 05/08/09. Excludes a gain on debt extinguishment of

approximately $10.8 million to be recognized during the second quarter.

12

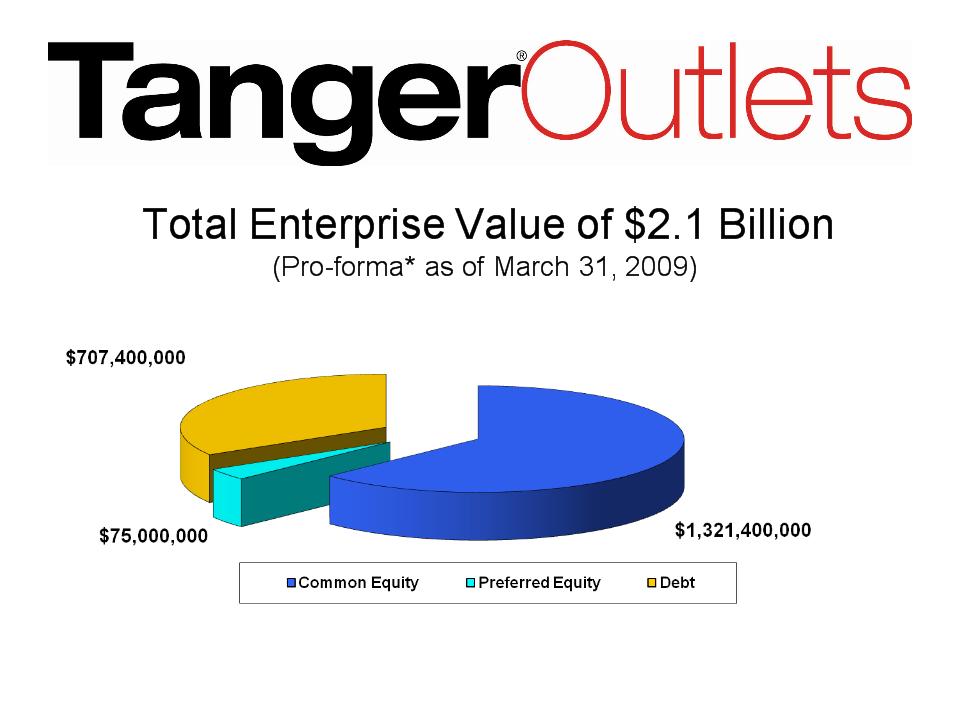

34%

63%

3%

* Reflects the reduction in debt and additional shares that resulted from the exchange offer

completed May 8, 2009.

completed May 8, 2009.

13

Summary of 2008 Financial Results

14

15

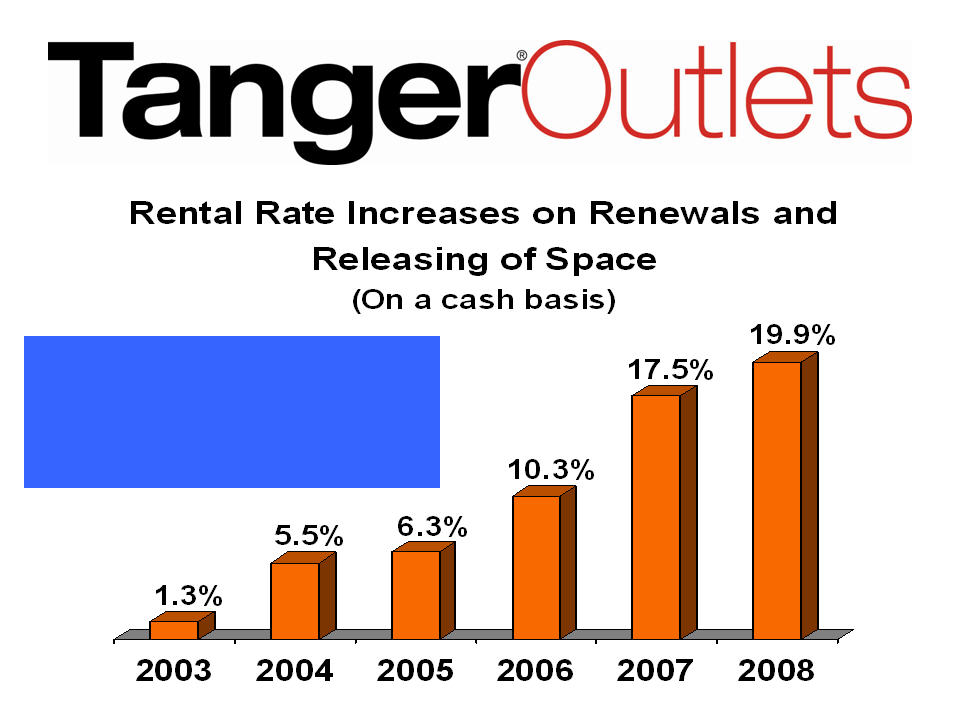

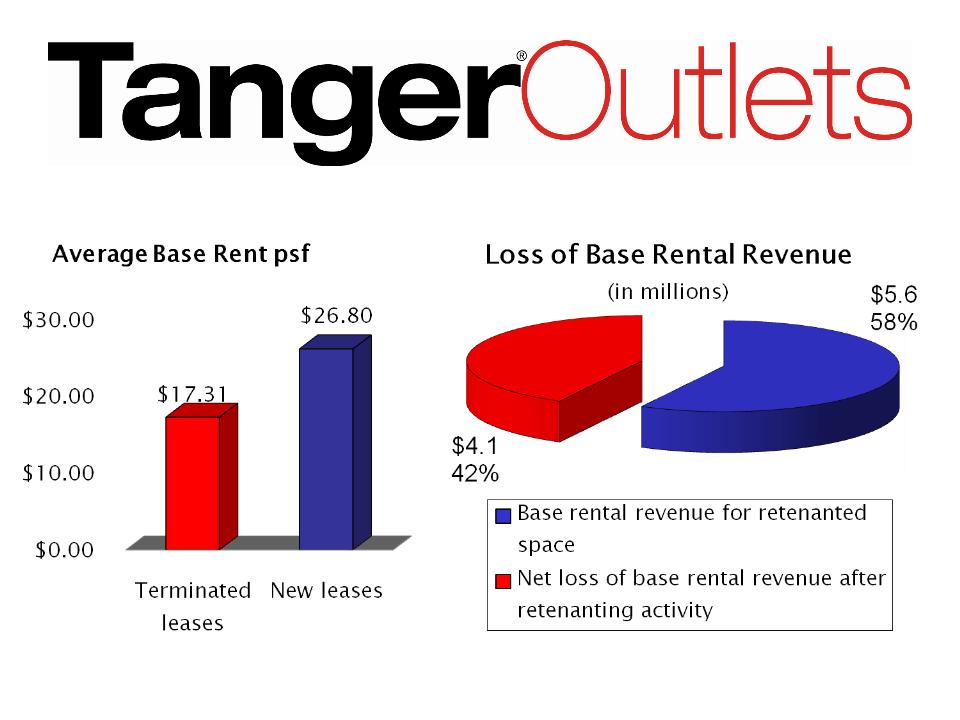

Straight-line releasing spreads = 44.1%

in 2008 (39.7% in 2007)

in 2008 (39.7% in 2007)

Straight-line renewal spreads =

17.5% in 2008 (13.9% in 2007)

17.5% in 2008 (13.9% in 2007)

17

18

19

Development Update -

New Properties

20

20

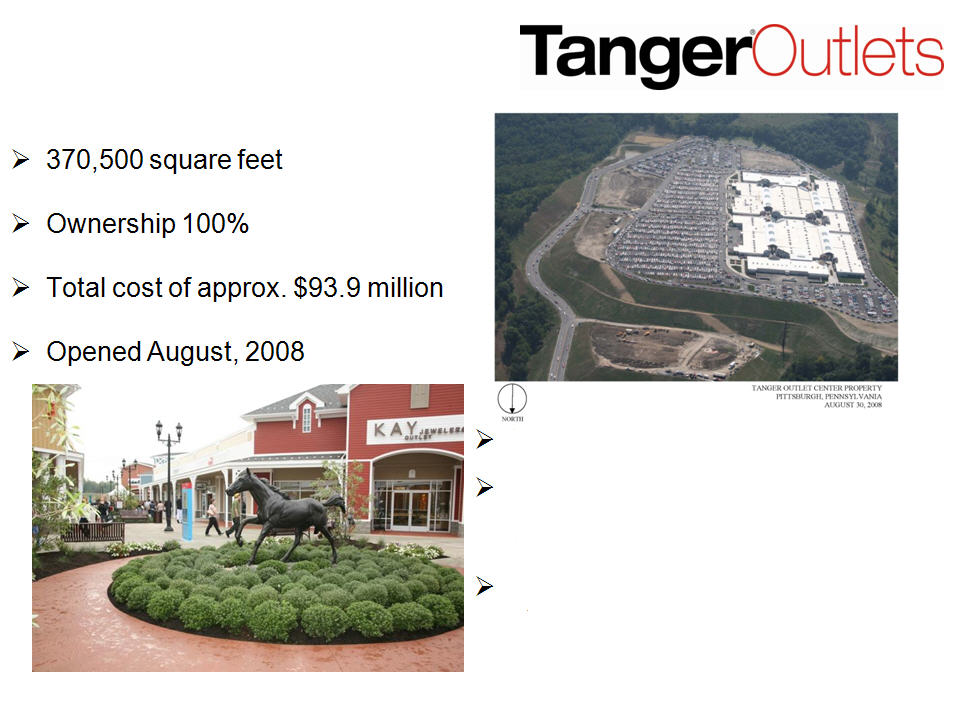

Washington, PA

(south of Pittsburgh)

(south of Pittsburgh)

82% leased at March 31, 2009

Construction financed through use

of lines of credit and tax increment

financing

of lines of credit and tax increment

financing

Estimated stabilized return on cost

of 10.0 to 10.5%

of 10.0 to 10.5%

21

21

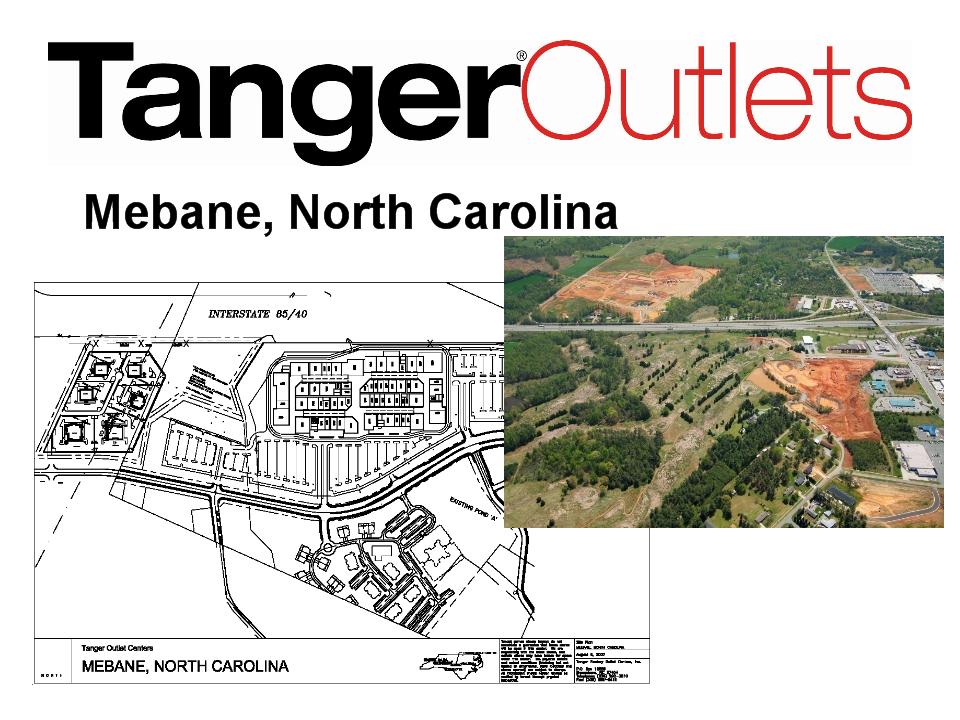

78% leased at March 31, 2009

Unconsolidated JV

Construction financed through

$284.0 million mortgage loan

maturing May 2012 and partner

equity

$284.0 million mortgage loan

maturing May 2012 and partner

equity

Estimated stabilized return on cost

of 8.5% to 9.0%

of 8.5% to 9.0%

22

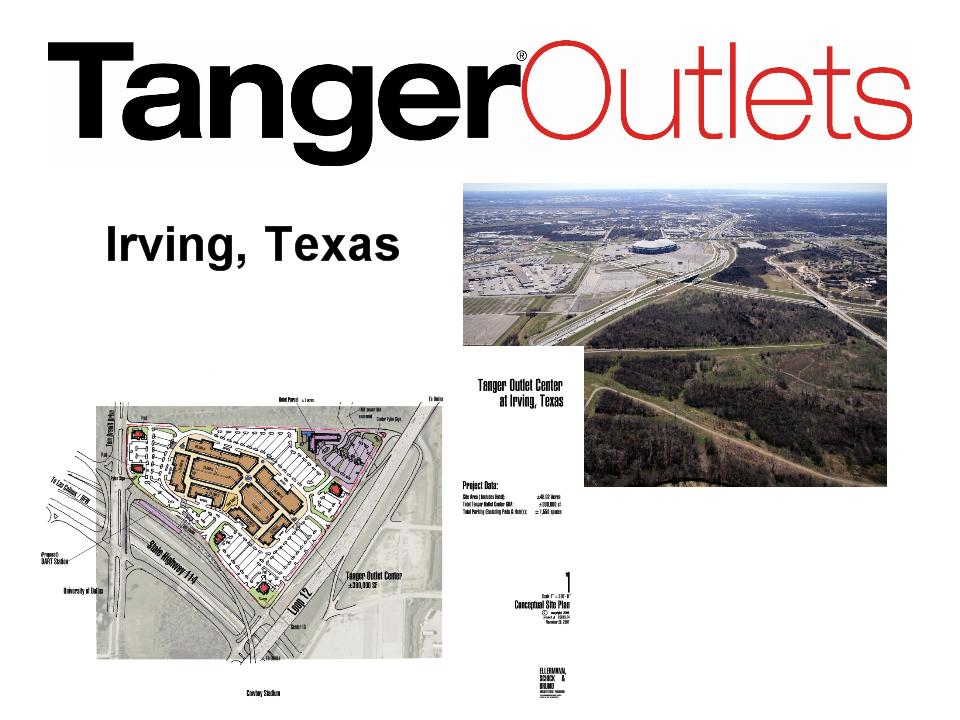

Development Update -

Pipeline

23

24

25

25

Internal Criteria for Development

Predevelopment costs are limited to those associated with:

Costs to control the

land (option contract costs)

Pre-leasing costs

Due diligence costs

Criteria required to purchase land and begin development

Positive results of

the due diligence process

Pre-leasing of 50%

or greater with an acceptable tenant mix and visibility for

leasing of the remaining leasable space to 75%

leasing of the remaining leasable space to 75%

Receipt of all non-appealable

permits required to obtain a building permit.

Acceptable return on cost analysis

26

Financial Strategies

27

27

Summary of Financial Strategies

The following are strategic objectives of Tanger’s financial decision

making process:

making process:

Focus on improving investment grade rating

Maintain quality coverage and leverage ratios

Continue the use of unsecured financing

Maintain relatively low usage on lines of credit

Use off balance sheet joint ventures only when

necessary

Maintain manageable levels of debt with staggered

maturities

Recycle capital through the sale of non-core

assets and land

parcels

parcels

Generate capital internally (cash flow in excess

of dividends paid)

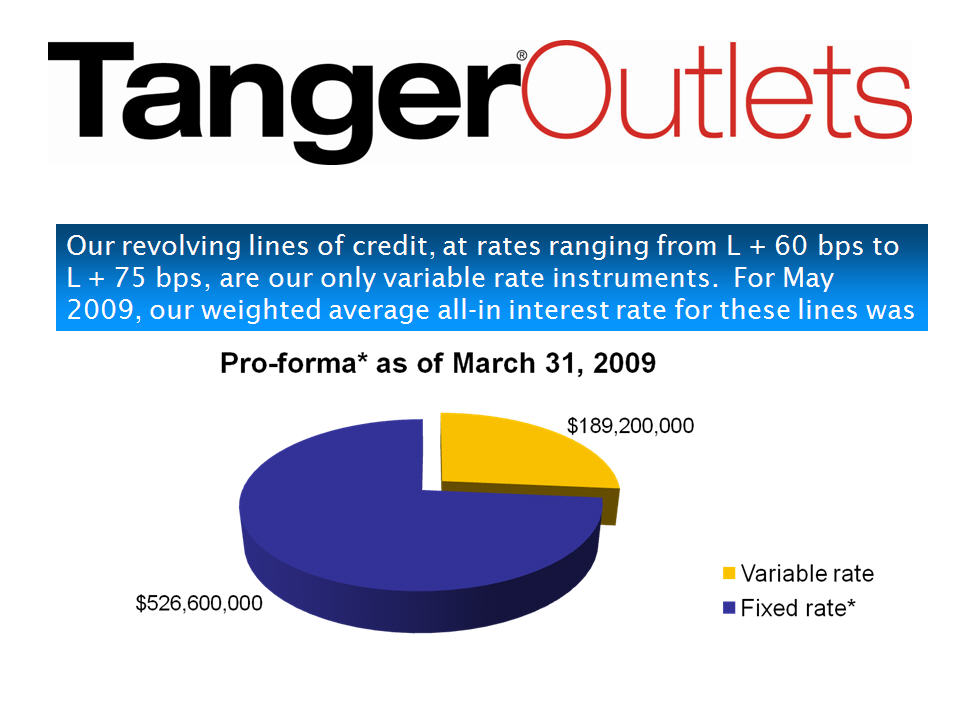

Limited Exposure to Rising Interest Rates

* Reflects the reduction in debt that resulted from the exchange offer completed 05/08/09.

28

29

29

Financial Capacity

Current capacity of $325 million under lines of credit

Bank of America, $100 million, 06/30/2011

maturity

Wells Fargo, $100 million, 06/30/2011 maturity

SunTrust, $40 million, 08/31/2011 maturity

BB&T, $35 million, 06/30/2011 maturity

Citicorp, $25 million, 06/30/2011 maturity

Wachovia, $25 million, 06/30/2009 maturity

Tanger’s line of credit usage is currently 60% of total available

capacity under lines of credit (as of May 19, 2009).

capacity under lines of credit (as of May 19, 2009).

30

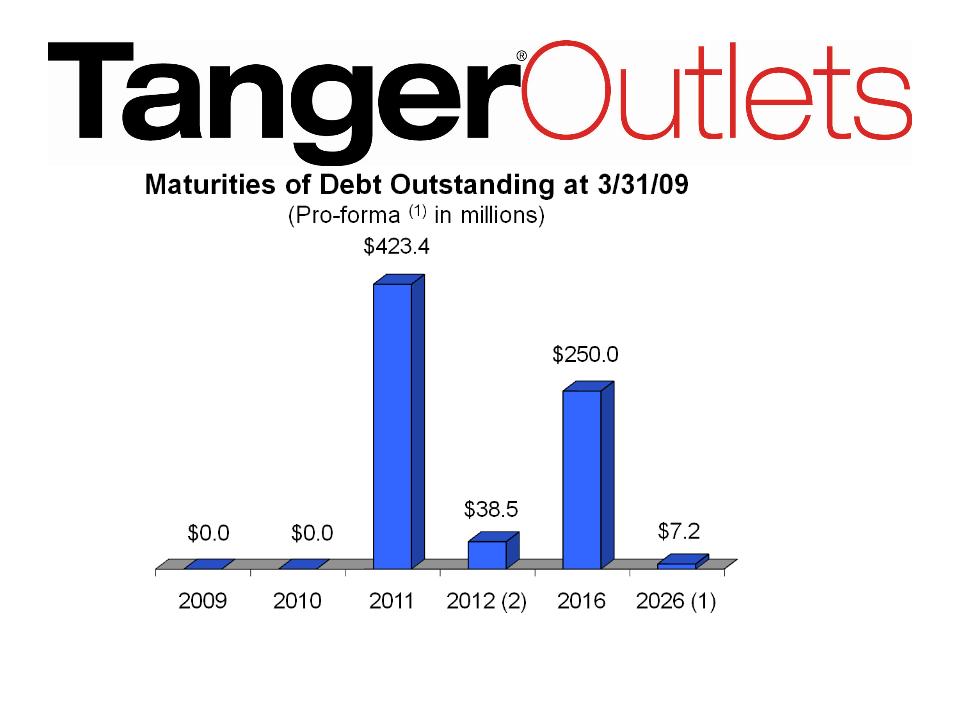

1. Represents convertible debt remaining after completion of exchange offer on 05/08/09.

Matures August 2026, but puttable at the holders’ option in August 2011.

Matures August 2026, but puttable at the holders’ option in August 2011.

2. Debt assumed as part of acquisition of Myrtle Beach 17 on 01/05/2009.

31

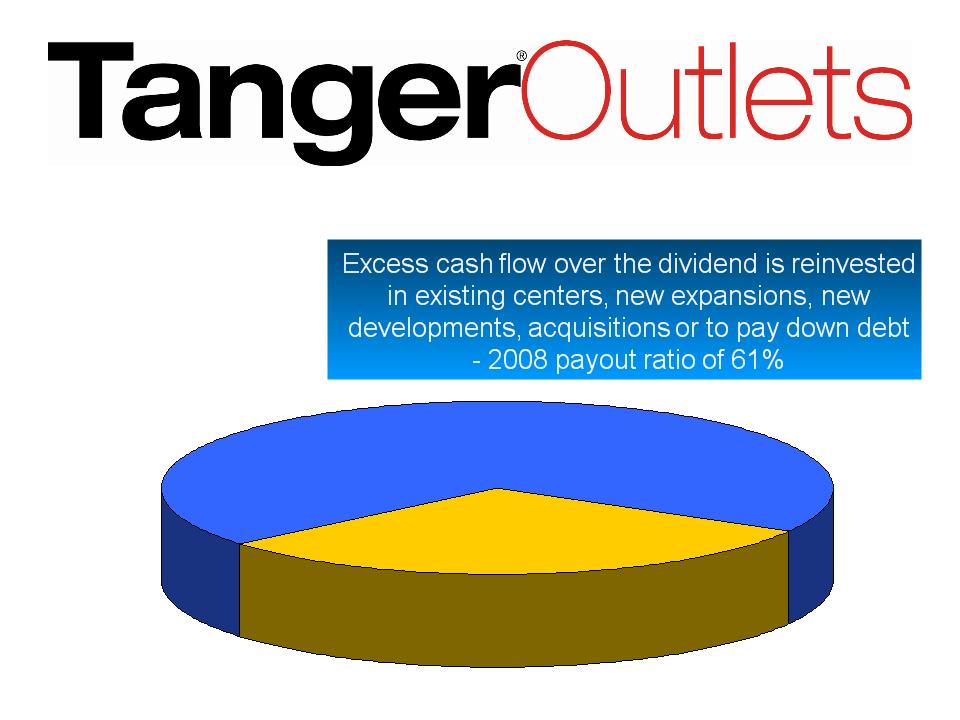

Reinvesting in the Company

$35.5 Million Excess Cash Flow

$56.4 Million Dividends

32

2009 Challenges

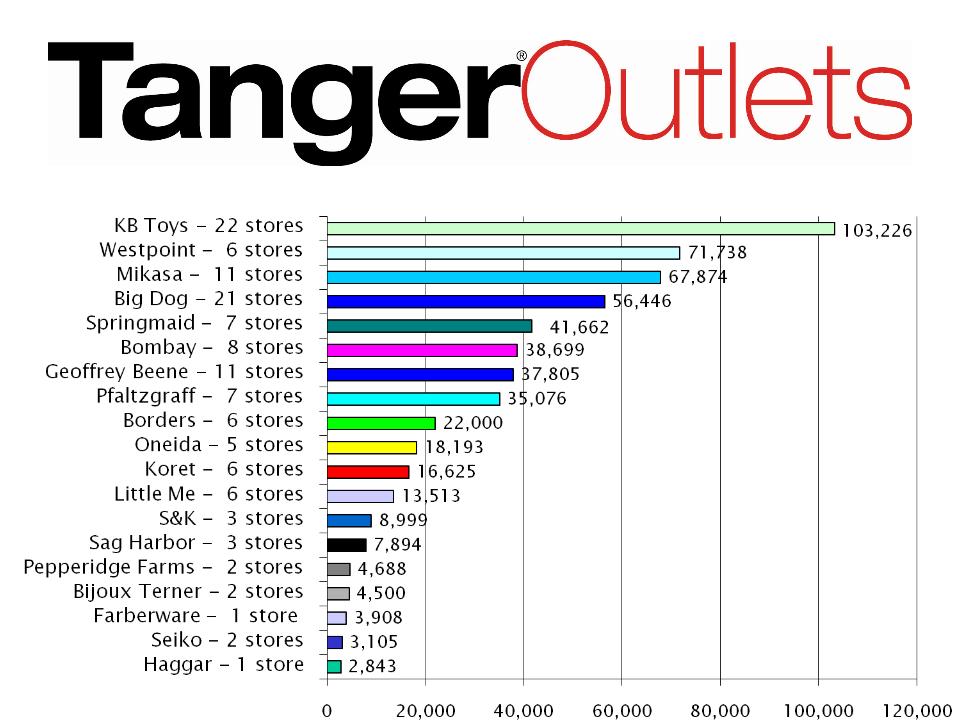

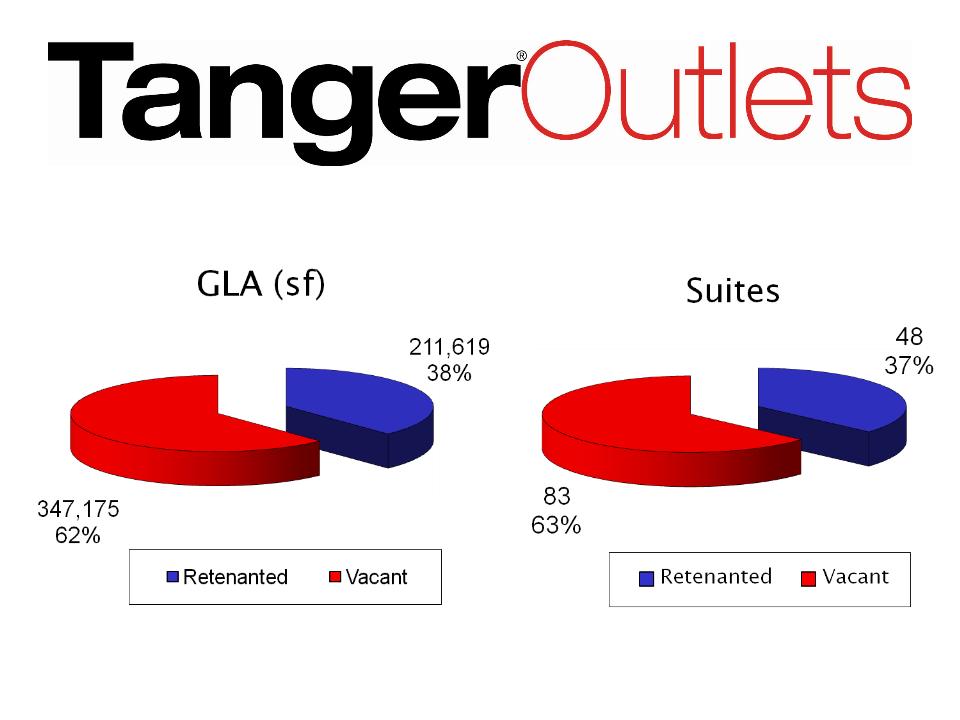

Lease Terminations 3Q07 through 1Q09

• Tenants 19

• Stores 131

• GLA 558,794

sf

• Average base rent $17.31

psf

• Base rental revenue $9.7 million

33

GLA Terminated by Tenant (sf)

34

Re-Tenanting Activity

35

Re-Tenanting Activity

36

37

37

Liquidity and access to capital

Line of credit capacity

Near term debt maturities

Rating agency ratings

Tenant’s performance in the Tanger portfolio

Analysis of Landlord Risk

Top Ten Tenants (in terms of Tanger revenues)

Tanger analyzes the following information for each of our

top ten tenants:

38

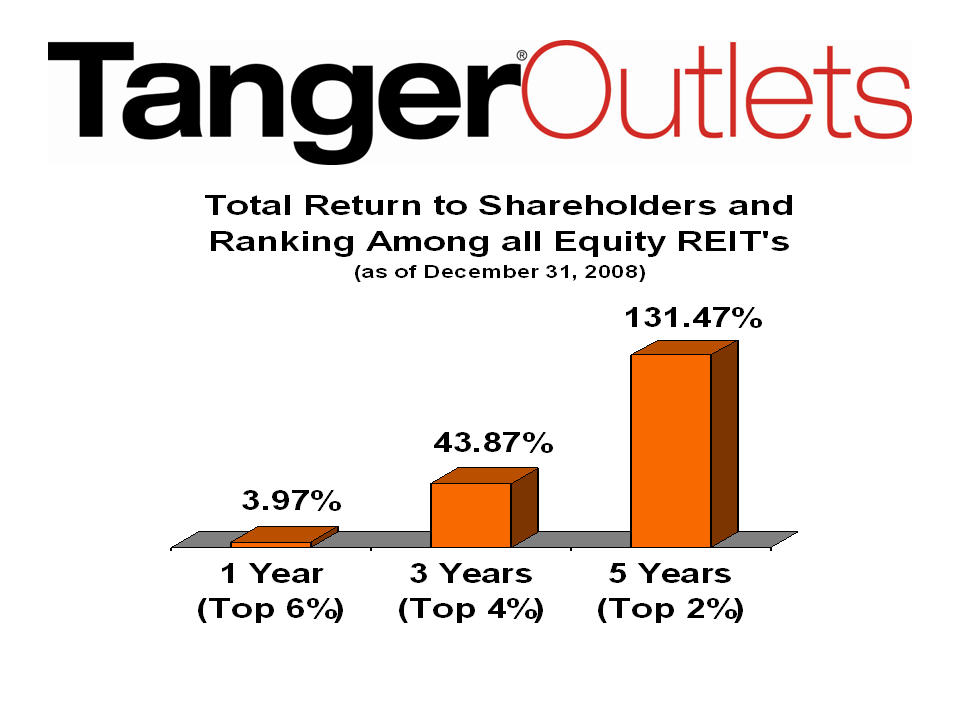

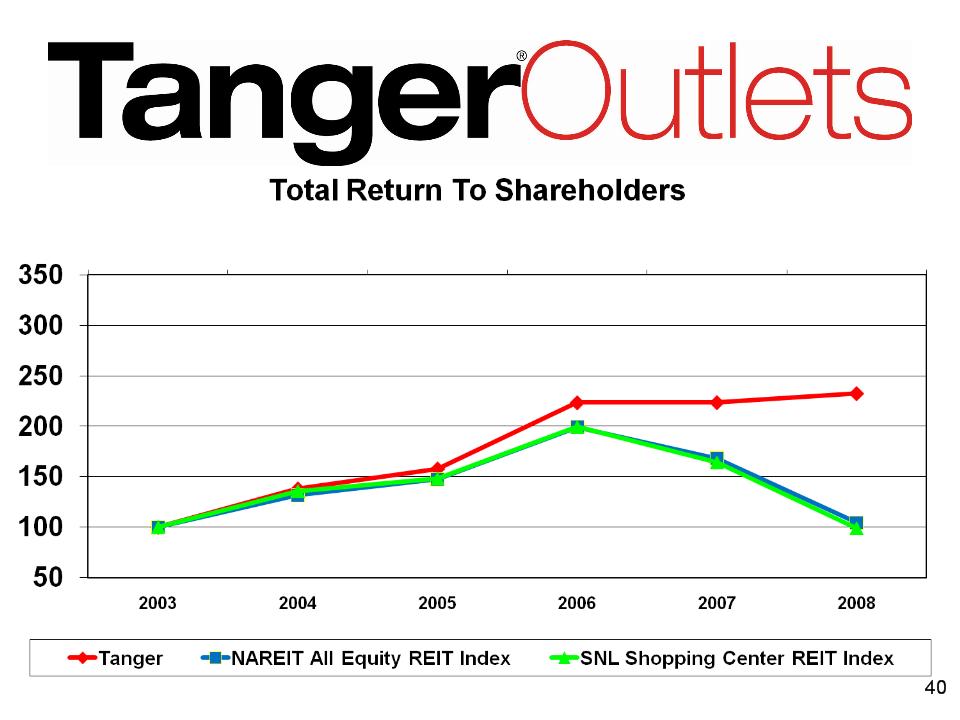

History of Consistent Results and

Investor Reward

Investor Reward

39

41

Summary

42

42

The strength and stability of our core operating portfolio, as well as the

strength of our balance sheet, leaves us poised to weather the current

economic conditions.

strength of our balance sheet, leaves us poised to weather the current

economic conditions.

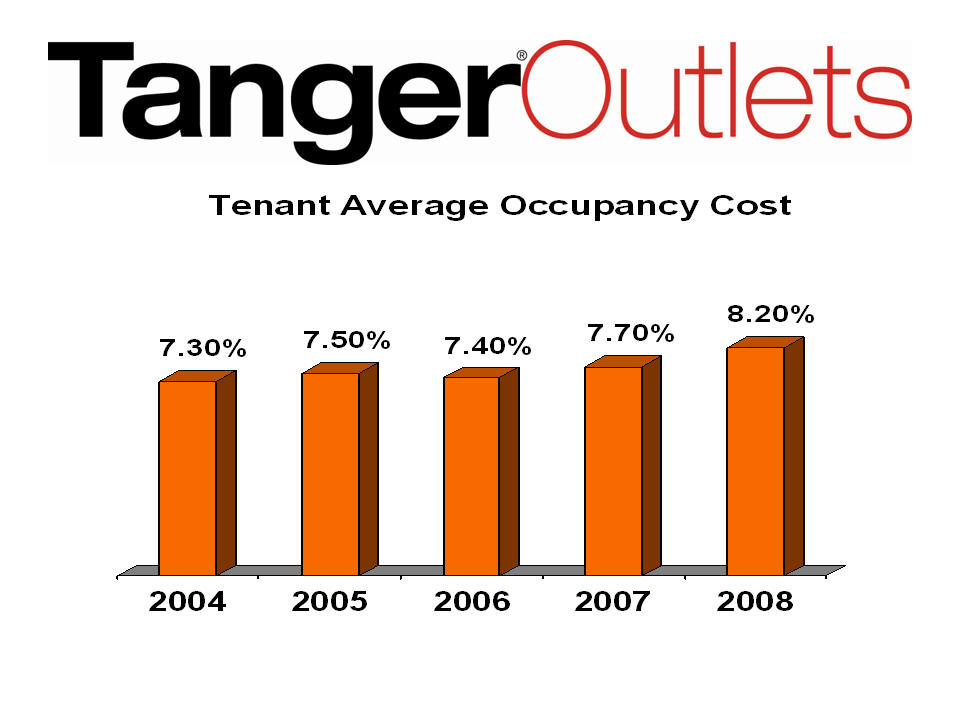

Low cost of occupancy helps

the outlet channel continue to be a

viable and profitable means of distribution for retailers and

manufacturers.

viable and profitable means of distribution for retailers and

manufacturers.

Tenant diversification provides

Tanger a distinct business advantage.

No single tenant represents more than 8.4% of our gross leasable

area or 5.3% of our total base and percentage rental income.

No single tenant represents more than 8.4% of our gross leasable

area or 5.3% of our total base and percentage rental income.

Geographical diversification of

our portfolio of 31 properties

throughout 21 states provides yet another Tanger advantage.

throughout 21 states provides yet another Tanger advantage.

Tenant Lease Term -

The typical Tanger lease term, about 5 years,

exceeds the duration of most economic downturns. Tenant rents are

fixed or escalate during the term of the lease.

exceeds the duration of most economic downturns. Tenant rents are

fixed or escalate during the term of the lease.

Strong brand reputation -

Shoppers have associated the Tanger

name with a superior shopping experience and true savings on the

best brand names in the nation for nearly 30 years.

name with a superior shopping experience and true savings on the

best brand names in the nation for nearly 30 years.

Summary

43

43

In these difficult economic times, our financial projections are both

conservative and achievable. In spite of increased projected

vacancy, we will be able to:

conservative and achievable. In spite of increased projected

vacancy, we will be able to:

Continue earnings growth

Increase average

rental rates on renewals and re-

tenanting

tenanting

Satisfy our cash requirements using net operating income

Maintain sufficient liquidity without additional required

financing until mid - 2011

financing until mid - 2011

Summary