EX-99.1

Published on November 4, 2025

EXHIBIT 99.1

Earnings Release and

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

Table of Contents

| Section | |||||

| Earnings Release | |||||

| Portfolio Data: | |||||

| Summary Operating Metrics | |||||

| Geographic Diversification | |||||

| Property Summary - Occupancy at End of Each Period Shown | |||||

| Portfolio Map | |||||

| Portfolio Occupancy at the End of Each Period | |||||

| Center Sales Per Square Foot Ranking | |||||

| Top 25 Tenants Based on Percentage of Total Annualized Base Rent | |||||

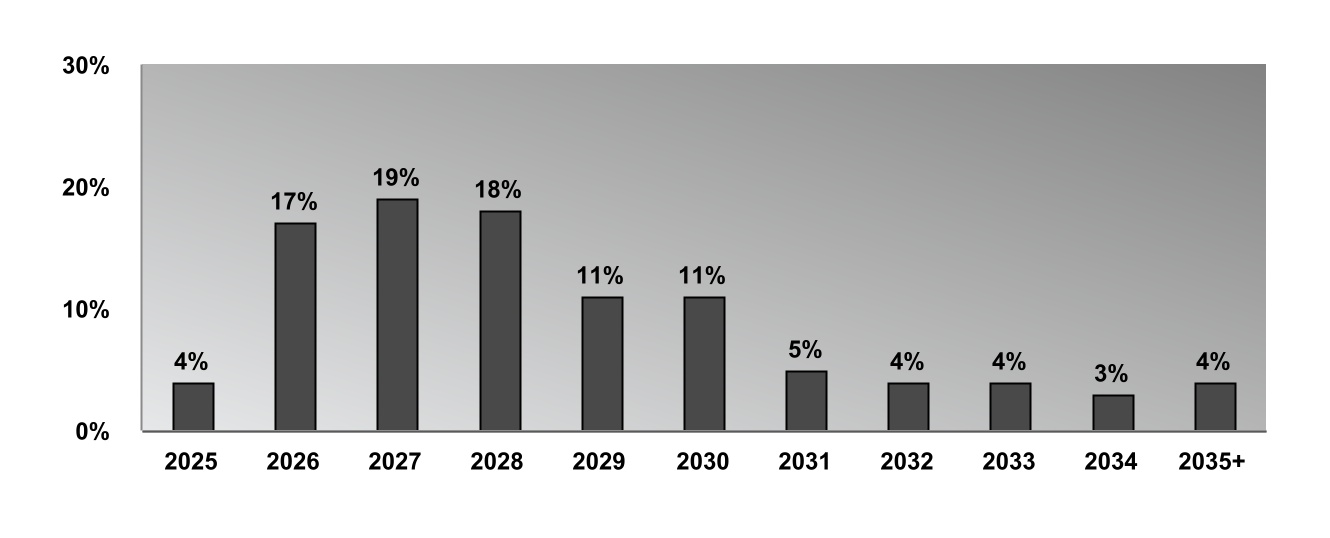

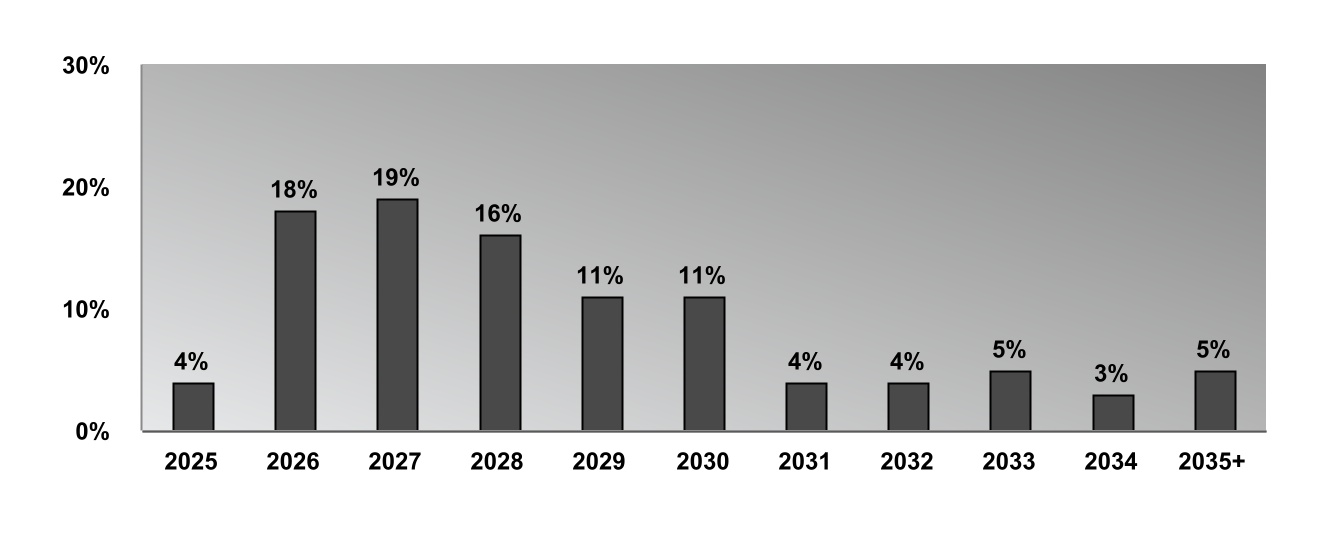

Lease Expirations | |||||

| Capital Expenditures | |||||

| Transaction Summary | |||||

| Leasing Activity | |||||

| Financial Data: | |||||

| Consolidated Balance Sheets | |||||

| Consolidated Statements of Operations | |||||

| Components of Rental Revenues | |||||

| Unconsolidated Joint Venture Information | |||||

| Debt Outstanding Summary | |||||

| Future Scheduled Principal Payments | |||||

| Financial Covenants | |||||

| Enterprise Value, Net Debt, Liquidity, Debt Ratios and Credit Ratings | |||||

| Non-GAAP and Supplemental Measures: | |||||

| FFO and FAD Analysis | |||||

| Portfolio NOI and Same Center NOI | |||||

| Adjusted EBITDA and EBITDAre | |||||

| Net Debt | |||||

| Pro Rata Balance Sheet Information | |||||

| Pro Rata Statement of Operations Information | |||||

| Guidance for 2025 | |||||

| Non-GAAP Definitions | |||||

| Investor Information | |||||

News Release

Tanger Reports Third Quarter 2025 Results and Raises Full-Year 2025 Guidance

Robust Tenant Demand Leads to Record Leasing Volume

Portfolio Achieves All-Time High Sales Productivity

Adds Sixth New Open-Air Center in Less Than Two Years

Greensboro, NC, November 4, 2025, Tanger® (NYSE:SKT), a leading owner and operator of outlet and open-air retail shopping destinations, today reported financial results and operating metrics for the three and nine months ended September 30, 2025.

“The successful execution of our strategic plan delivered another quarter of strong financial and operating results, contributing to an increase in our full-year guidance,” said Stephen Yalof, President and Chief Executive Officer. “We are seeing robust tenant demand with record leasing volume and continued growth from both existing and new tenants, including additional restaurants, entertainment destinations, and non-traditional outlet retailers. Our digital and on-center marketing initiatives are accelerating sales momentum and engaging customers across a wider demographic spectrum. We also advanced our strategic external growth with the acquisition of Legends Outlets, rebranded as Tanger Kansas City at Legends, representing the sixth center added to our portfolio over the past two years.”

Mr. Yalof continued, “We are well-positioned to unlock additional value for our stakeholders through organic growth and selectively acquiring and operating best-in-class open-air retail assets, backed by a strong balance sheet that provides liquidity and flexibility.”

Third Quarter Results

•Net income available to common shareholders was $0.28 per share, or $31.8 million, compared to $0.22 per share, or $24.6 million, for the prior year period.

•Funds From Operations (“FFO”) available to common shareholders was $0.60 per share, or $71.1 million, compared to $0.54 per share, or $62.7 million, for the prior year period.

•Core Funds From Operations (“Core FFO”) available to common shareholders was $0.60 per share, or $71.1 million, compared to $0.54 per share, or $62.7 million, for the prior year period.

Year-to-Date Results

•Net income available to common shareholders was $0.71 per share, or $80.7 million, compared to $0.65 per share, or $71.4 million, for the prior year period. Net income for the first nine months of 2025 includes a non-cash impairment charge of $0.04 per share, or $4.2 million, related to the center in Howell, Michigan that was sold in April 2025.

•FFO available to common shareholders was $1.70 per share, or $202.4 million, compared to $1.58 per share, or $182.2 million, for the prior year period.

•Core FFO available to common shareholders was $1.70 per share, or $202.4 million, compared to $1.60 per share, or $183.7 million, for the prior year period.

FFO and Core FFO are widely accepted supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. Definitions of these non-GAAP financial measures and statements of the reasons why management believes these non-GAAP financial measures provide useful information to investors about the Company’s financial condition and results of operations, and, if applicable, the other purposes for which management uses the measures, as well as reconciliations of these non-GAAP financial measures to GAAP net income, can be found later in this release. Per share amounts for net income, FFO and Core FFO are on a diluted basis.

Operating Metrics

Below are key portfolio results for the total portfolio, including the Company’s pro rata share of unconsolidated joint ventures.

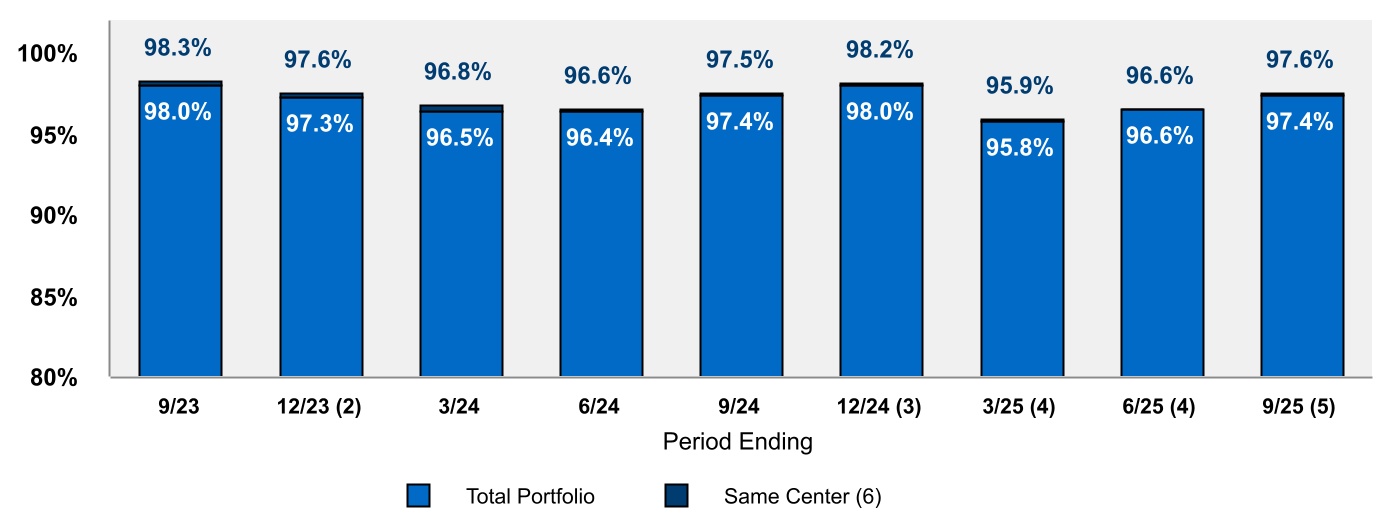

•Occupancy was 97.4% on September 30, 2025, compared to 96.6% on June 30, 2025 and 97.4% on September 30, 2024. On a same center basis, occupancy was 97.6% on September 30, 2025, compared to 96.6% on June 30, 2025 and 97.5% on September 30, 2024. The same center portfolio excludes The Promenade at Chenal, Pinecrest, and Tanger Kansas City at Legends, which were acquired in the last 12 months, and the sold center in Howell, Michigan for all periods presented.

i

•Same center net operating income (“Same Center NOI”), which is presented on a cash basis, increased 4.0% to $102.3 million for the third quarter of 2025 from $98.4 million for the third quarter of 2024 and increased 3.9% to $300.4 million for the first nine months of 2025 from $289.2 million for the first nine months of 2024.

•Average tenant sales per square foot was $475 for the twelve months ended September 30, 2025 compared to $465 for the twelve months ended June 30, 2025 and $438 for the twelve months ended September 30, 2024, reflecting the Company’s execution of its strategy to remerchandise, replace less productive tenants, and evolve its portfolio.

•On a same center basis (excluding The Promenade at Chenal, Pinecrest, Tanger Kansas City at Legends, Tanger Outlets Nashville and the center in Howell, Michigan), average tenant sales per square foot was $472 for the twelve months ended September 30, 2025 compared to $462 for the twelve months ended June 30, 2025 and $441 for the twelve months ended September 30, 2024.

•The occupancy cost ratio (“OCR”), representing annualized occupancy costs as a percentage of tenant sales, was 9.7% for the twelve months ended September 30, 2025 compared to 9.7% for the twelve months ended June 30, 2025 and 9.5% for the twelve months ended September 30, 2024.

•Lease termination fees (which are excluded from Same Center NOI) for the total portfolio totaled $85,000 for the third quarter of 2025 and $808,000 for the first nine months of 2025, compared to $351,000 for the third quarter of 2024 and $925,000 for the first nine months of 2024.

Same Center NOI is a supplemental non-GAAP financial measure of operating performance. A complete definition of Same Center NOI and a reconciliation to the nearest comparable GAAP measure can be found later in this release.

Leasing Activity

Leasing activity in the Company’s portfolio continues to be robust from both existing and new tenants. For the total domestic portfolio, including the Company’s pro rata share of domestic unconsolidated joint ventures, total renewed or re-tenanted leases (including leases for both comparable and non-comparable space) executed during the twelve months ended September 30, 2025 included 608 leases, totaling 2.9 million square feet, compared to 543 leases, totaling 2.6 million square feet, during the twelve months ended September 30, 2024.

Blended average rental rate spreads were 10.6% on a cash basis for leases executed for 2.6 million square feet of comparable space during the twelve months ended September 30, 2025. These blended rent spreads are comprised of re-tenanted rent spreads of 27.6% and renewal rent spreads of 7.9%.

As of September 30, 2025, the Company had renewals executed or in process for 72.7% of the space scheduled to expire during 2025 compared to 72.5% of expiring 2024 space as of September 30, 2024 (total portfolio, including the Company’s pro rata share of unconsolidated joint ventures).

Transaction Activity

In September 2025, the Company completed the acquisition of Legends Outlets, a 690,000-square-foot open-air, outlet center located in Kansas City, Kansas, for $130.0 million using available liquidity and the assumption of a $115 million commercial mortgage-backed security loan that matures in November 2027. In conjunction with the closing of the acquisition, the Company settled approximately $70 million of previously issued forward equity. The center, which has been rebranded as Tanger Kansas City at Legends, is Kansas’ only outlet center and serves as the retail anchor of Village West, the state’s top tourist destination. Management estimates the center to deliver an eight percent return during the first year, with potential for additional investment and growth over time. For additional information on this acquisition, please see the related press release, presentation, and video available at investors.tanger.com.

Balance Sheet and Liquidity

The following balance sheet and liquidity metrics are presented for the total portfolio, including the Company’s pro rata share of unconsolidated joint ventures. As of September 30, 2025:

•Net debt to Adjusted EBITDAre (calculated as Net debt divided by Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“Adjusted EBITDAre”)) was 5.0x for the twelve months ended September 30, 2025 compared to 5.0x for the twelve months ended June 30, 2025 and 4.8x for the year ended December 31, 2024. Management estimates that Net debt to Adjusted EBITDAre would range from 4.7x to 4.8x for the September 30, 2025 period assuming a full twelve months of Adjusted EBITDAre for the acquisitions of The Promenade at Chenal, Pinecrest, and Tanger Kansas City at Legends and after giving effect to the April 2025 sale of the center in Howell, Michigan.

•Interest coverage ratio (calculated as Adjusted EBITDAre divided by interest expense) was 4.7x for both the first nine months of 2025 and the twelve months ended September 30, 2025.

•Cash and cash equivalents totaled $20.7 million with $560.0 million of availability on the Company’s $620.0 million unsecured lines of credit. Additionally, the Company had $37.2 million of restricted cash.

ii

•Total outstanding debt aggregated $1.8 billion with $60.0 million (principal) of floating rate debt, representing approximately 3% of total debt outstanding and approximately 1% of total enterprise value.

•Weighted average interest rate was 4.1%, including current swaps, and weighted average term to maturity of outstanding debt, including extension options, was approximately 3.1 years.

•Approximately 88% of the total portfolio’s square footage was unencumbered by mortgages, with secured debt of $341.9 million (principal), representing approximately 19% of total debt outstanding.

•Funds Available for Distribution (“FAD”) payout ratio was 58% for the first nine months of 2025.

Adjusted EBITDAre, Net debt and FAD are supplemental non-GAAP financial measures of operating performance. Definitions of Adjusted EBITDAre, Net debt and FAD and reconciliations to the nearest comparable GAAP measures are included later in this release.

Dividend

In October 2025, the Company’s Board of Directors authorized a quarterly cash dividend of $0.2925 per share, payable on November 14, 2025 to holders of record on October 31, 2025.

Guidance for 2025

Based on the Company’s results to date, its view on current market conditions, and its outlook for the remainder of 2025, management currently believes the Company’s full-year 2025 net income and FFO per share will be as follows:

| For the year ending December 31, 2025: | Current | Previous | |||||||||||||||

| Low Range | High Range | Low Range | High Range | ||||||||||||||

| Estimated diluted net income per share | $0.95 | $0.99 | $0.93 | $1.00 | |||||||||||||

| Depreciation and amortization of real estate assets - consolidated and the Company’s share of unconsolidated joint ventures | 1.30 | 1.30 | 1.28 | 1.28 | |||||||||||||

| Impairment charge - consolidated | 0.04 | 0.04 | 0.04 | 0.04 | |||||||||||||

Estimated diluted FFO per share (1) | $2.28 | $2.32 | $2.24 | $2.31 | |||||||||||||

(1) Amounts may not recalculate due to the effect of rounding.

The above estimates reflect the following key assumptions (dollars in millions):

| For the year ending December 31, 2025: | Current | Previous | |||||||||||||||

| Low Range | High Range | Low Range | High Range | ||||||||||||||

| Same Center NOI growth - total portfolio at pro rata share | 3.50 | % | 4.25 | % | 2.5 | % | 4.0 | % | |||||||||

| General and administrative expense | $76.5 | $79.5 | $76.5 | $79.5 | |||||||||||||

| Interest expense - consolidated | $65.3 | $66.3 | $63.7 | $65.3 | |||||||||||||

Other income (expense) (1) | $— | $0.5 | $— | $1.0 | |||||||||||||

| Annual recurring capital expenditures, renovations and second generation tenant allowances | $60.0 | $65.0 | $55.0 | $65.0 | |||||||||||||

(1) Includes interest income.

Weighted average diluted common shares are expected to range from approximately 115.0 million to 115.5 million for earnings per share and 119.5 million to 120.0 million for FFO and Core FFO per share. The current guidance reflects the September 2025 acquisition of Tanger Kansas City at Legends including the assumption of a $115 million mortgage loan and settlement of $70 million (1.9 million shares) of forward sale agreements under the Company’s at-the-market stock offering program. Guidance does not include the impact of any additional acquisition or sale of any outparcels, properties or joint venture interests, or any additional financing activity.

Third Quarter 2025 Conference Call

Tanger will host a conference call to discuss its third quarter 2025 results for analysts, investors and other interested parties on Wednesday, November 5, 2025, at 8:30 a.m. Eastern Time. To access the conference call, listeners should dial 1-877-605-1702. Alternatively, a live audio webcast of this call will be available to the public on Tanger’s Investor Relations website, investors.tanger.com. A telephone replay of the call will be available from November 5, 2025 at approximately 11:30 a.m. through

iii

November 19, 2025 at 11:59 p.m. by dialing 1-877-660-6853, replay access code #13755622. An online archive of the webcast will also be available through November 19, 2025.

Upcoming Events

The Company is scheduled to participate in the following upcoming events:

•Jefferies Real Estate Conference held at the 1 Hotel South Beach in Miami, FL from November 18 through November 19, 2025

•Tour of Tanger Outlets Fort Worth in Fort Worth, TX on December 8, 2025

•Nareit’s REITworld: 2025 Investor Conference held at the Hilton Anatole in Dallas, TX from December 9 through December 10, 2025

About Tanger®

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries. Tanger’s portfolio of 38 outlet centers and three open-air lifestyle centers includes more than 16 million square feet well positioned across tourist destinations and vibrant markets in 22 U.S. states and Canada. A publicly traded REIT since 1993, Tanger continues to innovate the retail experience for its shoppers with over 3,000 stores operated by more than 800 different brand name companies. Tanger is furnishing a Form 8-K with the Securities and Exchange Commission (“SEC”) that includes a supplemental information package for the quarter ended September 30, 2025. For more information on Tanger, call 1-800-4TANGER or visit tanger.inc.

The Company uses, and intends to continue to use, its Investor Relations website, which can be found at investors.tanger.com, as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD. Additional information about the Company can also be found through social media channels. The Company encourages investors and others interested in the Company to review the information on its Investor Relations website and on social media channels. The information contained on, or that may be accessed through, our website or social media platforms is not incorporated by reference into, and is not a part of, this document.

Safe Harbor Statement

Certain statements made in this earnings release contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements are generally identifiable by use of the words “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions that do not report historical matters. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Although we believe the expectations reflected in these forward-looking statements are based on reasonable assumptions, future events and actual results, performance, transactions or achievements, financial and otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. As a result, you should not rely on or construe any forward-looking statements in this release as predictions of future events or as guarantees of future performance. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this release. All of our forward-looking statements are qualified in their entirety by this statement.

There are a number of risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this release. Any forward-looking statements should be considered in light of the risks, uncertainties and other factors referred to in Item 1A. “Risk Factors” in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q and in our other filings with the SEC. Such risks and uncertainties include, but are not limited to: risks associated with general economic and financial conditions, including inflationary pressures and recessionary fears, newly-imposed and potentially additional U.S. tariffs and responsive non-U.S. tariffs, increased capital costs and capital markets volatility, increases in unemployment and reduced consumer confidence and spending; risks related to our ability to develop new retail centers or expand existing retail centers successfully; risks related to the financial performance and market value of our retail centers and the potential for reductions in asset valuations and related impairment charges; our dependence on rental income from real property; the relative illiquidity of real property investments; failure of our acquisitions or dispositions of retail centers to achieve anticipated results; competition for the acquisition and development of retail centers, and our inability to complete the acquisitions of retail centers we may identify; competition for tenants with competing retail centers and our inability to execute leases with tenants on terms consistent with our expectations; the diversification of our tenant mix and our entry into the operation of full price retail may not achieve our expected results; risks associated with environmental regulations; risks associated with possible terrorist activity or other acts or threats of violence and threats to public safety; risks related to international military conflicts, international trade disputes and foreign currency volatility; the fact that certain of our leases include co-tenancy and/or sales-based provisions that may allow a tenant to pay reduced rent

iv

and/or terminate a lease prior to its natural expiration; our dependence on the results of operations of our retailers and their bankruptcy, early termination or closing could adversely affect us; the impact of geopolitical conflicts; the impact of a prolonged government shutdown; the immediate and long-term impact of the outbreak of a highly infectious or contagious disease on our tenants and on our business (including the impact of actions taken to contain the outbreak or mitigate its impact); the fact that certain of our properties are subject to ownership interests held by third parties, whose interests may conflict with ours; risks related to climate change; risks related to uninsured losses; the risk that consumer, travel, shopping and spending habits may change; risks associated with our Canadian investments; risks associated with attracting and retaining key personnel; risks associated with debt financing; risks associated with our guarantees of debt for, or other support we may provide to, joint venture properties; the effectiveness of our interest rate hedging arrangements; our potential failure to qualify as a REIT; our legal obligation to pay dividends to our shareholders; legislative or regulatory actions that could adversely affect our shareholders; our dependence on distributions from the Operating Partnership to meet our financial obligations, including dividends; risks of costs and disruptions from cyber-attacks or acts of cyber-terrorism on our information systems or on third party systems that we use; unanticipated threats to our business from changes in information and other technologies, including artificial intelligence; and the uncertainties of costs to comply with regulatory changes and other important factors which may cause actual results to differ materially from current expectations include, but are not limited to, those set forth under Item 1A - “Risk Factors” in the Company’s and the Operating Partnership’s Annual Report on Form 10-K for the year ended December 31, 2024 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, and in other reports that we file with the SEC.

Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Investor Contact Information | Media Contact Information | |||||||||||||

Doug McDonald | HUNTER | |||||||||||||

SVP, Treasurer and Investments | tanger@hunterpr.com | |||||||||||||

336-856-6066 | ||||||||||||||

tangerir@tanger.com | ||||||||||||||

v

TANGER INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

| Three months ended | Nine months ended | ||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Rental revenue | $137,225 | $125,221 | $399,945 | $365,349 | |||||||||||||||||||

| Management, leasing and other services | 2,507 | 2,485 | 7,152 | 7,095 | |||||||||||||||||||

| Other revenue | 5,476 | 5,295 | 14,168 | 12,884 | |||||||||||||||||||

| Total revenues | 145,208 | 133,001 | 421,265 | 385,328 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Property operating | 43,809 | 40,247 | 126,002 | 113,261 | |||||||||||||||||||

General and administrative (1) | 18,614 | 18,215 | 56,599 | 56,518 | |||||||||||||||||||

| Impairment charge | — | — | 4,249 | — | |||||||||||||||||||

| Depreciation and amortization | 37,103 | 35,376 | 110,857 | 103,410 | |||||||||||||||||||

| Total expenses | 99,526 | 93,838 | 297,707 | 273,189 | |||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||

| Interest expense | (16,439) | (15,493) | (48,610) | (45,546) | |||||||||||||||||||

| Other income (expense) | (116) | (52) | 75 | 755 | |||||||||||||||||||

| Total other income (expense) | (16,555) | (15,545) | (48,535) | (44,791) | |||||||||||||||||||

| Income before equity in earnings of unconsolidated joint ventures | 29,127 | 23,618 | 75,023 | 67,348 | |||||||||||||||||||

| Equity in earnings of unconsolidated joint ventures | 4,221 | 2,312 | 9,654 | 7,803 | |||||||||||||||||||

| Net income | 33,348 | 25,930 | 84,677 | 75,151 | |||||||||||||||||||

| Noncontrolling interests in Operating Partnership | (1,321) | (1,074) | (3,363) | (3,122) | |||||||||||||||||||

| Noncontrolling interests in other consolidated partnerships | — | — | — | 80 | |||||||||||||||||||

| Net income attributable to Tanger Inc. | 32,027 | 24,856 | 81,314 | 72,109 | |||||||||||||||||||

| Allocation of earnings to participating securities | (224) | (232) | (651) | (692) | |||||||||||||||||||

| Net income available to common shareholders of Tanger Inc. | $31,803 | $24,624 | $80,663 | $71,417 | |||||||||||||||||||

| Basic earnings per common share: | |||||||||||||||||||||||

| Net income | $0.28 | $0.23 | $0.72 | $0.66 | |||||||||||||||||||

| Diluted earnings per common share: | |||||||||||||||||||||||

| Net income | $0.28 | $0.22 | $0.71 | $0.65 | |||||||||||||||||||

(1)The nine months ended September 30, 2024 includes $1.6 million of executive severance costs.

vi

TANGER INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(Unaudited)

| September 30, | December 31, | ||||||||||

| 2025 | 2024 | ||||||||||

| Assets | |||||||||||

| Rental property: | |||||||||||

| Land | $342,203 | $311,355 | |||||||||

| Buildings, improvements and fixtures | 3,318,981 | 3,089,239 | |||||||||

| Construction in progress | 18,310 | 7,453 | |||||||||

| 3,679,494 | 3,408,047 | ||||||||||

| Accumulated depreciation | (1,483,480) | (1,428,017) | |||||||||

| Total rental property, net | 2,196,014 | 1,980,030 | |||||||||

| Cash and cash equivalents | 13,029 | 46,992 | |||||||||

| Restricted cash | 37,199 | — | |||||||||

| Investments in unconsolidated joint ventures | 65,695 | 65,665 | |||||||||

| Deferred lease costs and other intangibles, net | 115,999 | 85,028 | |||||||||

| Operating lease right-of-use assets | 81,741 | 76,099 | |||||||||

| Prepaids and other assets | 126,260 | 127,369 | |||||||||

| Total assets | $2,635,937 | $2,381,183 | |||||||||

| Liabilities and Equity | |||||||||||

| Liabilities | |||||||||||

| Debt: | |||||||||||

| Senior, unsecured notes, net | $1,043,131 | $1,041,710 | |||||||||

| Unsecured term loan, net | 323,831 | 323,182 | |||||||||

| Mortgages payable, net | 186,050 | 58,867 | |||||||||

| Unsecured lines of credit | 60,000 | — | |||||||||

| Total debt | 1,613,012 | 1,423,759 | |||||||||

| Accounts payable and accrued expenses | 98,527 | 107,775 | |||||||||

| Operating lease liabilities | 90,071 | 84,499 | |||||||||

| Other liabilities | 102,176 | 85,476 | |||||||||

| Total liabilities | 1,903,786 | 1,701,509 | |||||||||

| Commitments and contingencies | |||||||||||

| Equity | |||||||||||

| Tanger Inc.: | |||||||||||

Common shares, $0.01 par value, 300,000,000 shares authorized, 115,115,168 and 112,738,633 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively | 1,151 | 1,127 | |||||||||

| Paid in capital | 1,260,435 | 1,190,746 | |||||||||

| Accumulated distributions in excess of net income | (528,996) | (511,816) | |||||||||

| Accumulated other comprehensive loss | (28,944) | (27,687) | |||||||||

| Equity attributable to Tanger Inc. | 703,646 | 652,370 | |||||||||

| Equity attributable to noncontrolling interests: | |||||||||||

| Noncontrolling interests in Operating Partnership | 28,505 | 27,304 | |||||||||

| Noncontrolling interests in other consolidated partnerships | — | — | |||||||||

| Total equity | 732,151 | 679,674 | |||||||||

| Total liabilities and equity | $2,635,937 | $2,381,183 | |||||||||

vii

TANGER INC. AND SUBSIDIARIES

CENTER INFORMATION

(Unaudited)

| September 30, | ||||||||||||||

| 2025 | 2024 | |||||||||||||

| Gross Leasable Area Open at End of Period (in thousands): | ||||||||||||||

| Consolidated | 13,989 | 12,690 | ||||||||||||

| Unconsolidated | 2,113 | 2,113 | ||||||||||||

| Pro rata share of unconsolidated | 1,056 | 1,056 | ||||||||||||

| Managed | 457 | 758 | ||||||||||||

Total Owned and/or Managed Properties (1) | 16,559 | 15,561 | ||||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs (1) | 15,045 | 13,746 | ||||||||||||

| Centers in Operation at End of Period: | ||||||||||||||

| Consolidated | 34 | 32 | ||||||||||||

| Unconsolidated | 6 | 6 | ||||||||||||

| Managed | 1 | 2 | ||||||||||||

| Total Owned and/or Managed Properties | 41 | 40 | ||||||||||||

| Ending Occupancy: | ||||||||||||||

Consolidated (2) | 97.4 | % | 97.3 | % | ||||||||||

| Unconsolidated | 98.3 | % | 98.2 | % | ||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs (2) | 97.4 | % | 97.4 | % | ||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs - Same Center (3) | 97.6 | % | 97.5 | % | ||||||||||

Total U.S. States Operated in at End of Period (4) | 22 | 20 | ||||||||||||

(1)Amounts may not recalculate due to the effect of rounding.

(2)September 2025 occupancy includes the results of The Promenade at Chenal, Pinecrest, and Tanger Kansas City at Legends, which were acquired in the fourth quarter of 2024, the first quarter of 2025, and the third quarter of 2025, respectively, and excludes the center in Howell, Michigan that was sold in April 2025.

(3)Excludes the results of The Promenade at Chenal, Pinecrest, and Tanger Kansas City at Legends for September 2025 and the center in Howell, Michigan for September 2024.

(4)The Company also has an ownership interest in two centers located in Ontario, Canada.

viii

TANGER INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP SUPPLEMENTAL MEASURES (1)

(in thousands, except per share)

(Unaudited)

Below is a reconciliation of Net Income to FFO and Core FFO:

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Net income | $33,348 | $25,930 | $84,677 | $75,151 | ||||||||||||||||||||||

| Adjusted for: | ||||||||||||||||||||||||||

| Depreciation and amortization of real estate assets - consolidated | 35,835 | 34,357 | 107,198 | 100,764 | ||||||||||||||||||||||

| Depreciation and amortization of real estate assets - unconsolidated joint ventures | 2,292 | 2,850 | 7,458 | 7,450 | ||||||||||||||||||||||

Impairment charge - consolidated | — | — | 4,249 | — | ||||||||||||||||||||||

| FFO | 71,475 | 63,137 | 203,582 | 183,365 | ||||||||||||||||||||||

| FFO attributable to noncontrolling interests in other consolidated partnerships | — | — | — | 80 | ||||||||||||||||||||||

| Allocation of earnings to participating securities | (420) | (418) | (1,184) | (1,248) | ||||||||||||||||||||||

FFO available to common shareholders (2) | $71,055 | $62,719 | $202,398 | $182,197 | ||||||||||||||||||||||

| As further adjusted for: | ||||||||||||||||||||||||||

Executive departure-related adjustments (3) | — | — | — | 1,554 | ||||||||||||||||||||||

| Impact of above adjustments to the allocation of earnings to participating securities | — | — | — | (10) | ||||||||||||||||||||||

Core FFO available to common shareholders (2) | $71,055 | $62,719 | $202,398 | $183,741 | ||||||||||||||||||||||

FFO available to common shareholders per share - diluted (2) | $0.60 | $0.54 | $1.70 | $1.58 | ||||||||||||||||||||||

Core FFO available to common shareholders per share - diluted (2) | $0.60 | $0.54 | $1.70 | $1.60 | ||||||||||||||||||||||

| Weighted Average Shares: | ||||||||||||||||||||||||||

| Basic weighted average common shares | 113,005 | 108,972 | 112,689 | 108,675 | ||||||||||||||||||||||

| Effect of dilutive securities: | ||||||||||||||||||||||||||

| Equity awards | 1,564 | 1,732 | 1,539 | 1,671 | ||||||||||||||||||||||

| Diluted weighted average common shares (for earnings per share computations) | 114,569 | 110,704 | 114,228 | 110,346 | ||||||||||||||||||||||

| Exchangeable operating partnership units | 4,663 | 4,708 | 4,667 | 4,708 | ||||||||||||||||||||||

Diluted weighted average common shares (for FFO and Core FFO per share computations) (2) | 119,232 | 115,412 | 118,895 | 115,054 | ||||||||||||||||||||||

(1)Refer to Non-GAAP Definitions beginning on page xv for definitions of the non-GAAP supplemental measures used in this release.

(2)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

(3)For the nine months ended September 30, 2024, represents executive severance costs.

ix

Below is a reconciliation of FFO to FAD (1):

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| FFO available to common shareholders | $71,055 | $62,719 | $202,398 | $182,197 | ||||||||||||||||||||||

| Adjusted for: | ||||||||||||||||||||||||||

| Corporate depreciation | 1,268 | 1,019 | 3,659 | 2,646 | ||||||||||||||||||||||

| Amortization of finance costs | 940 | 914 | 2,801 | 2,609 | ||||||||||||||||||||||

| Amortization of net debt discount | 137 | 191 | 550 | 548 | ||||||||||||||||||||||

| Amortization of equity-based compensation | 3,258 | 2,875 | 9,471 | 8,980 | ||||||||||||||||||||||

| Straight-line rent adjustments | (1,775) | (374) | (2,069) | (361) | ||||||||||||||||||||||

| Market rent adjustments | 78 | 166 | (185) | 393 | ||||||||||||||||||||||

| Second generation tenant allowances and lease incentives | (5,049) | (11,802) | (12,154) | (20,858) | ||||||||||||||||||||||

| Capital improvements | (11,757) | (10,418) | (25,260) | (23,707) | ||||||||||||||||||||||

| Adjustments from unconsolidated joint ventures | (882) | (845) | (2,355) | (1,149) | ||||||||||||||||||||||

FAD available to common shareholders (2) | $57,273 | $44,445 | $176,856 | $151,298 | ||||||||||||||||||||||

| Dividends per share | $0.2925 | $0.275 | $0.86 | $0.81 | ||||||||||||||||||||||

| FFO payout ratio | 49 | % | 51 | % | 51 | % | 51 | % | ||||||||||||||||||

| FAD payout ratio | 61 | % | 71 | % | 58 | % | 61 | % | ||||||||||||||||||

Diluted weighted average common shares (2) | 119,232 | 115,412 | 118,895 | 115,054 | ||||||||||||||||||||||

(1)Refer to page ix for a reconciliation of net income to FFO available to common shareholders.

(2)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

x

Below is a reconciliation of Net Income to Portfolio NOI and Same Center NOI for the consolidated portfolio and total portfolio at pro rata share:

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Net income | $33,348 | $25,930 | $84,677 | $75,151 | ||||||||||||||||||||||

| Adjusted to exclude: | ||||||||||||||||||||||||||

| Equity in earnings of unconsolidated joint ventures | (4,221) | (2,312) | (9,654) | (7,803) | ||||||||||||||||||||||

| Interest expense | 16,439 | 15,493 | 48,610 | 45,546 | ||||||||||||||||||||||

| Other (income) expense | 116 | 52 | (75) | (755) | ||||||||||||||||||||||

| Impairment charge | — | — | 4,249 | — | ||||||||||||||||||||||

| Depreciation and amortization | 37,103 | 35,376 | 110,857 | 103,410 | ||||||||||||||||||||||

| Other non-property income | (323) | (199) | (831) | (1,000) | ||||||||||||||||||||||

| Corporate general and administrative expenses | 18,614 | 18,231 | 56,622 | 56,556 | ||||||||||||||||||||||

Non-cash adjustments (1) | (1,705) | (214) | (2,284) | 28 | ||||||||||||||||||||||

| Lease termination fees | (85) | (335) | (806) | (875) | ||||||||||||||||||||||

| Portfolio NOI - Consolidated | 99,286 | 92,022 | 291,365 | 270,258 | ||||||||||||||||||||||

| Non-same center NOI - Consolidated | (5,178) | (980) | (14,146) | (2,865) | ||||||||||||||||||||||

Same Center NOI - Consolidated (2) | $94,108 | $91,042 | $277,219 | $267,393 | ||||||||||||||||||||||

| Portfolio NOI - Consolidated | $99,286 | $92,022 | $291,365 | $270,258 | ||||||||||||||||||||||

Pro rata share of unconsolidated joint ventures (3) | 8,238 | 7,349 | 23,208 | 21,824 | ||||||||||||||||||||||

Portfolio NOI - Total portfolio at pro rata share (3) | 107,524 | 99,371 | 314,573 | 292,082 | ||||||||||||||||||||||

Non-same center NOI - Total portfolio at pro rata share (3) | (5,178) | (980) | (14,146) | (2,865) | ||||||||||||||||||||||

Same Center NOI - Total portfolio at pro rata share (2) (3) | $102,346 | $98,391 | $300,427 | $289,217 | ||||||||||||||||||||||

(1)Non-cash items include straight-line rent, above and below market rent amortization, straight-line rent expense on land leases, and gains or losses on outparcel sales, as applicable.

(2)Centers excluded from Same Center NOI:

| Little Rock | December 2024 | Acquired | Consolidated | ||||||||

| Cleveland | February 2025 | Acquired | Consolidated | ||||||||

| Kansas City | September 2025 | Acquired | Consolidated | ||||||||

| Howell | April 2025 | Sold | Consolidated | ||||||||

(3)Pro rata share metrics are presented on a constant currency basis. Constant currency is a non-GAAP measure, calculated by applying the average foreign exchange rate for the current period to all periods presented.

xi

Reconciliation of Net Income to Adjusted EBITDA (in thousands)

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Net income | $33,348 | $25,930 | $84,677 | $75,151 | ||||||||||||||||||||||

| Adjusted to exclude: | ||||||||||||||||||||||||||

| Interest expense, net | 16,331 | 15,513 | 48,136 | 45,108 | ||||||||||||||||||||||

| Income tax expense (benefit) | 257 | — | 519 | (248) | ||||||||||||||||||||||

| Depreciation and amortization | 37,103 | 35,376 | 110,857 | 103,410 | ||||||||||||||||||||||

| Impairment charge - consolidated | — | — | 4,249 | — | ||||||||||||||||||||||

Compensation-related adjustments (1) | — | — | — | 1,554 | ||||||||||||||||||||||

| Adjusted EBITDA | $87,039 | $76,819 | $248,438 | $224,975 | ||||||||||||||||||||||

| Twelve months ended | ||||||||||||||

| September 30, | December 31, | |||||||||||||

| 2025 | 2024 | |||||||||||||

| Net income | $112,286 | $102,760 | ||||||||||||

| Adjusted to exclude: | ||||||||||||||

| Interest expense, net | 62,442 | 59,414 | ||||||||||||

| Income tax expense (benefit) | 812 | 45 | ||||||||||||

| Depreciation and amortization | 146,137 | 138,690 | ||||||||||||

| Impairment charge - consolidated | 4,249 | — | ||||||||||||

Compensation-related adjustments (1) | — | 1,554 | ||||||||||||

| Adjusted EBITDA | $325,926 | $302,463 | ||||||||||||

(1)For the nine months ended September 30, 2024 and twelve months ended December 31, 2024, represents executive severance costs.

xii

Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre (in thousands)

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||||

| Net income | $33,348 | $25,930 | $84,677 | $75,151 | ||||||||||||||||||||||

| Adjusted to exclude: | ||||||||||||||||||||||||||

| Interest expense, net | 16,331 | 15,513 | 48,136 | 45,108 | ||||||||||||||||||||||

| Income tax expense (benefit) | 257 | — | 519 | (248) | ||||||||||||||||||||||

| Depreciation and amortization | 37,103 | 35,376 | 110,857 | 103,410 | ||||||||||||||||||||||

| Impairment charge - consolidated | — | — | 4,249 | — | ||||||||||||||||||||||

| Pro rata share of interest expense, net - unconsolidated joint ventures | 1,968 | 2,186 | 6,514 | 6,539 | ||||||||||||||||||||||

| Pro rata share of depreciation and amortization - unconsolidated joint ventures | 2,292 | 2,850 | 7,458 | 7,450 | ||||||||||||||||||||||

| EBITDAre | $91,299 | $81,855 | $262,410 | $237,410 | ||||||||||||||||||||||

Compensation-related adjustments (1) | — | — | — | 1,554 | ||||||||||||||||||||||

| Adjusted EBITDAre | $91,299 | $81,855 | $262,410 | $238,964 | ||||||||||||||||||||||

| Twelve months ended | ||||||||||||||

| September 30, | December 31, | |||||||||||||

| 2025 | 2024 | |||||||||||||

| Net income | $112,286 | $102,760 | ||||||||||||

| Adjusted to exclude: | ||||||||||||||

| Interest expense, net | 62,442 | 59,414 | ||||||||||||

| Income tax expense (benefit) | 812 | 45 | ||||||||||||

| Depreciation and amortization | 146,137 | 138,690 | ||||||||||||

| Impairment charge - consolidated | 4,249 | — | ||||||||||||

| Pro rata share of interest expense, net - unconsolidated joint ventures | 8,700 | 8,725 | ||||||||||||

Pro rata share of depreciation and amortization - unconsolidated joint ventures | 9,342 | 9,334 | ||||||||||||

| EBITDAre | $343,968 | $318,968 | ||||||||||||

Compensation-related adjustments (1) | — | 1,554 | ||||||||||||

| Adjusted EBITDAre | $343,968 | $320,522 | ||||||||||||

(1)For the nine months ended September 30, 2024 and twelve months ended December 31, 2024, represents executive severance costs.

xiii

Below is a reconciliation of Total debt to Net debt for the consolidated portfolio and total portfolio at pro rata share:

| September 30, 2025 | ||||||||||||||||||||

| Consolidated | Pro Rata Share of Unconsolidated JVs | Total at Pro Rata Share | ||||||||||||||||||

| Total debt | $1,613,012 | $158,265 | $1,771,277 | |||||||||||||||||

| Less: | ||||||||||||||||||||

| Cash and cash equivalents | (13,029) | (7,692) | (20,721) | |||||||||||||||||

| Restricted cash | (37,199) | — | (37,199) | |||||||||||||||||

| Total cash and cash equivalents and restricted cash | (50,228) | (7,692) | (57,920) | |||||||||||||||||

| Net debt | $1,562,784 | $150,573 | $1,713,357 | |||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||

| Consolidated | Pro Rata Share of Unconsolidated JVs | Total at Pro Rata Share | ||||||||||||||||||

| Total debt | $1,423,759 | $158,596 | $1,582,355 | |||||||||||||||||

| Less: | ||||||||||||||||||||

| Cash and cash equivalents | (46,992) | (8,740) | (55,732) | |||||||||||||||||

| Net debt | $1,376,767 | $149,856 | $1,526,623 | |||||||||||||||||

xiv

NON-GAAP DEFINITIONS

Funds From Operations

Funds From Operations (“FFO”) is a widely used measure of the operating performance for real estate companies that supplements net income (loss) determined in accordance with generally accepted accounting principles in the United States (“GAAP”). We determine FFO based on the definition set forth by the National Association of Real Estate Investment Trusts (“Nareit”), of which we are a member. In December 2018, Nareit issued “Nareit Funds From Operations White Paper - 2018 Restatement,” which clarifies, where necessary, existing guidance and consolidates alerts and policy bulletins into a single document for ease of use. Nareit defines FFO as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains or losses from sales of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect FFO on the same basis.

FFO is intended to exclude historical cost depreciation of real estate as required by GAAP, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization of real estate assets, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income (loss).

We present FFO because we consider it an important supplemental measure of our operating performance. In addition, a portion of cash bonus compensation to certain members of management is based on our FFO or Core FFO, which is described in the section below. We believe it is useful for investors to have enhanced transparency into how we evaluate our performance and that of our management. In addition, FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is also widely used by us and others in our industry to evaluate and price potential acquisition candidates. We believe that FFO payout ratio, which represents regular distributions to common shareholders and unitholders of the Operating Partnership expressed as a percentage of FFO, is useful to investors because it facilitates the comparison of dividend coverage between REITs. Nareit has encouraged its member companies to report their FFO as a supplemental, industry-wide standard measure of REIT operating performance.

FFO has significant limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and FFO does not reflect any cash requirements for such replacements; and

•Other companies in our industry may calculate FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, FFO should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or our dividend paying capacity. We compensate for these limitations by relying primarily on our GAAP results and using FFO only as a supplemental measure.

Core FFO

We present Core Funds From Operations (“Core FFO”) as a supplemental measure of our performance. We define Core FFO as FFO further adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance. These further adjustments are itemized in the table above. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Core FFO you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Core FFO should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

We present Core FFO because we believe it assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we believe it is useful for investors to have enhanced transparency into how we evaluate management’s performance and the effectiveness of our business strategies. We use Core FFO when certain material, unplanned transactions occur as a

xv

factor in evaluating management’s performance and to evaluate the effectiveness of our business strategies, and may use Core FFO when determining incentive compensation.

Core FFO has limitations as an analytical tool. Some of these limitations are:

•Core FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•Core FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Core FFO does not reflect any cash requirements for such replacements;

•Core FFO does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and

•Other companies in our industry may calculate Core FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Core FFO should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Core FFO only as a supplemental measure.

Funds Available for Distribution

Funds Available for Distribution (“FAD”) is a non-GAAP financial measure that we define as FFO (defined as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains or losses from sales of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect FFO on the same basis), excluding corporate depreciation, amortization of finance costs, amortization of net debt discount (premium), amortization of equity-based compensation, straight-line rent amounts, market rent amounts, second generation tenant allowances and lease incentives, recurring capital improvement expenditures, and our share of the items listed above for our unconsolidated joint ventures. Investors, analysts and the Company utilize FAD as an indicator of common dividend potential. The FAD payout ratio, which represents regular distributions to common shareholders and unitholders of the Operating Partnership expressed as a percentage of FAD, facilitates the comparison of dividend coverage between REITs.

We believe that net income (loss) is the most directly comparable GAAP financial measure to FAD. FAD does not represent cash generated from operating activities in accordance with GAAP and should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of liquidity or our ability to make distributions. Other companies in our industry may calculate FAD differently than we do, limiting its usefulness as a comparative measure.

Portfolio Net Operating Income and Same Center Net Operating Income

We present portfolio net operating income (“Portfolio NOI”) and same center net operating income (“Same Center NOI”) as supplemental measures of our operating performance. Portfolio NOI represents our property level net operating income, which is defined as total operating revenues less property operating expenses and excludes termination fees and non-cash adjustments including straight-line rent, net above and below market rent amortization, impairment charges, loss on early extinguishment of debt and gains or losses on the sale of assets recognized during the periods presented. We define Same Center NOI as Portfolio NOI for the properties that were operational for the entire portion of both comparable reporting periods and which were not acquired, or subject to a material expansion or non-recurring event, such as a natural disaster, during the comparable reporting periods. We present Portfolio NOI and Same Center NOI on both a consolidated and total portfolio, including pro rata share of unconsolidated joint ventures, basis.

We believe Portfolio NOI and Same Center NOI are non-GAAP metrics used by industry analysts, investors and management to measure the operating performance of our properties because they provide performance measures directly related to the revenues and expenses involved in owning and operating real estate assets and provide a perspective not immediately apparent from net income (loss), FFO or Core FFO. Because Same Center NOI excludes properties developed, redeveloped, acquired and sold; as well as non-cash adjustments, gains or losses on the sale of outparcels and termination rents; it highlights operating trends such as occupancy levels, rental rates and operating costs on properties that were operational for both comparable periods. Portfolio NOI and Same Center NOI should not be considered alternatives to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity or our ability to make distributions. Other REITs may use different methodologies for calculating Portfolio NOI and Same Center NOI, and accordingly, our Portfolio NOI and Same Center NOI may not be comparable to other REITs.

xvi

Portfolio NOI and Same Center NOI should not be considered alternatives to net income (loss) or as an indicator of our financial performance since they do not reflect the entire operations of our portfolio, nor do they reflect the impact of general and administrative expenses, acquisition-related expenses, interest expense, depreciation and amortization costs, other non-property income and losses, the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, or trends in development and construction activities which are significant economic costs and activities that could materially impact our results from operations. Because of these limitations, Portfolio NOI and Same Center NOI should not be viewed in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Portfolio NOI and Same Center NOI only as supplemental measures.

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre

We present Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) as adjusted for items described below (“Adjusted EBITDA”), EBITDA for Real Estate (“EBITDAre”) and Adjusted EBITDAre, all non-GAAP measures, as supplemental measures of our operating performance. Each of these measures is defined as follows:

We define Adjusted EBITDA as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP before net interest expense, income taxes (if applicable), depreciation and amortization, gains and losses on sale of operating properties, joint venture properties, outparcels and other assets, impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate, compensation related to voluntary retirement plan and other executive officer severance, certain executive departure-related adjustments, gain on sale of non-real estate asset, casualty gains and losses, gains and losses on early extinguishment of debt, net and other items that we do not consider indicative of the Company’s ongoing operating performance.

We determine EBITDAre based on the definition set forth by Nareit, which is defined as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP before net interest expense, income taxes (if applicable), depreciation and amortization, gains and losses on sale of operating properties, gains and losses on change of control and impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate and after adjustments to reflect our share of the EBITDAre of unconsolidated joint ventures.

Adjusted EBITDAre is defined as EBITDAre excluding gains and losses on early extinguishment of debt, net, casualty gains and losses, compensation related to voluntary retirement plan and other executive officer severance, gain on sale of non-real estate asset, gains and losses on sale of outparcels, and other items that we do not consider indicative of the Company’s ongoing operating performance.

We present Adjusted EBITDA, EBITDAre and Adjusted EBITDAre as we believe they are useful for investors, creditors and rating agencies as they provide additional performance measures that are independent of a Company’s existing capital structure to facilitate the evaluation and comparison of the Company’s operating performance to other REITs and provide a more consistent metric for comparing the operating performance of the Company’s real estate between periods.

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre have significant limitations as analytical tools, including:

•They do not reflect our net interest expense;

•They do not reflect gains or losses on sales of operating properties or impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate;

•Adjusted EBITDA and Adjusted EBITDAre do not reflect gains and losses on extinguishment of debt and other items that may affect operations; and

•Other companies in our industry may calculate these measures differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA, EBITDAre and Adjusted EBITDAre should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA, EBITDAre and Adjusted EBITDAre only as supplemental measures.

Net Debt

We define Net debt as total debt less cash and cash equivalents, including restricted cash, and short-term investments and present this metric for both the consolidated portfolio and for the total portfolio, including the consolidated portfolio and the Company’s pro rata share of unconsolidated joint ventures. Net debt is a component of the Net debt to Adjusted EBITDA ratio, which is defined as Net debt for the respective portfolio divided by Adjusted EBITDA (consolidated portfolio) or Adjusted EBITDAre (total portfolio at pro rata share). We use the Net debt to Adjusted EBITDA and the Net debt to Adjusted EBITDAre ratios to evaluate the Company’s leverage. We believe this measure is an important indicator of the Company’s ability to service its long-term debt obligations.

xvii

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

Notice

For a more detailed discussion of the factors that affect our operating results, interested parties should review the Tanger Inc. Annual Report on Form 10-K for the year ended December 31, 2024 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, when available.

This Supplemental Operating and Financial Data is not an offer to sell or a solicitation to buy any securities of the Company. Any offers to sell or solicitations to buy any securities of the Company shall be made only by means of a prospectus.

Safe Harbor Statement

Certain statements made in this supplement contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements are generally identifiable by use of the words “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions that do not report historical matters. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Although we believe the expectations reflected in these forward-looking statements are based on reasonable assumptions, future events and actual results, performance, transactions or achievements, financial and otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. As a result, you should not rely on or construe any forward-looking statements in this supplement as predictions of future events or as guarantees of future performance. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this supplement. All of our forward-looking statements are qualified in their entirety by this statement.

There are a number of risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this supplement. Any forward-looking statements should be considered in light of the risks, uncertainties and other factors referred to in Item 1A. “Risk Factors” in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q and in our other filings with the SEC. Such risks and uncertainties include, but are not limited to: risks associated with general economic and financial conditions, including inflationary pressures and recessionary fears, newly-imposed and potentially additional U.S. tariffs and responsive non-U.S. tariffs, increased capital costs and capital markets volatility, increases in unemployment and reduced consumer confidence and spending; risks related to our ability to develop new retail centers or expand existing retail centers successfully; risks related to the financial performance and market value of our retail centers and the potential for reductions in asset valuations and related impairment charges; our dependence on rental income from real property; the relative illiquidity of real property investments; failure of our acquisitions or dispositions of retail centers to achieve anticipated results; competition for the acquisition and development of retail centers, and our inability to complete the acquisitions of retail centers we may identify; competition for tenants with competing retail centers and our inability to execute leases with tenants on terms consistent with our expectations; the diversification of our tenant mix and our entry into the operation of full price retail may not achieve our expected results; risks associated with environmental regulations; risks associated with possible terrorist activity or other acts or threats of violence and threats to public safety; risks related to international military conflicts, international trade disputes and foreign currency volatility; the fact that certain of our leases include co-tenancy and/or sales-based provisions that may allow a tenant to pay reduced rent and/or terminate a lease prior to its natural expiration; our dependence on the results of operations of our retailers and their bankruptcy, early termination or closing could adversely affect us; the impact of geopolitical conflicts; the impact of a prolonged government shutdown; the immediate and long-term impact of the outbreak of a highly infectious or contagious disease on our tenants and on our business (including the impact of actions taken to contain the outbreak or mitigate its impact); the fact that certain of our properties are subject to ownership interests held by third parties, whose interests may conflict with ours; risks related to climate change; risks related to uninsured losses; the risk that consumer, travel, shopping and spending habits may change; risks associated with our Canadian investments; risks associated with attracting and retaining key personnel; risks associated with debt financing; risks associated with our guarantees of debt for, or other support we may provide to, joint venture properties; the effectiveness of our interest rate hedging arrangements; our potential failure to qualify as a REIT; our legal obligation to pay dividends to our shareholders; legislative or regulatory actions that could adversely affect our shareholders; our dependence on distributions from the Operating Partnership to meet our financial obligations, including dividends; risks of costs and disruptions from cyber-attacks or acts of cyber-terrorism on our information systems or on third party systems that we use;

1

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

unanticipated threats to our business from changes in information and other technologies, including artificial intelligence; and the uncertainties of costs to comply with regulatory changes and other important factors which may cause actual results to differ materially from current expectations include, but are not limited to, those set forth under Item 1A - “Risk Factors” in the Company’s and the Operating Partnership’s Annual Report on Form 10-K for the year ended December 31, 2024 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, and in other reports that we file with the SEC.

Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

2

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

Summary Operating Metrics

| September 30, | ||||||||||||||

| 2025 | 2024 | |||||||||||||

| Centers in Operation at End of Period: | ||||||||||||||

| Consolidated | 34 | 32 | ||||||||||||

| Unconsolidated | 6 | 6 | ||||||||||||

| Managed | 1 | 2 | ||||||||||||

| Total Owned and/or Managed Properties | 41 | 40 | ||||||||||||

| Gross Leasable Area (“GLA”) Open at End of Period (in thousands): | ||||||||||||||

| Consolidated | 13,989 | 12,690 | ||||||||||||

| Unconsolidated | 2,113 | 2,113 | ||||||||||||

| Pro rata share of unconsolidated | 1,056 | 1,056 | ||||||||||||

| Managed | 457 | 758 | ||||||||||||

| Total Owned and/or Managed Properties | 16,559 | 15,561 | ||||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs (1) | 15,045 | 13,746 | ||||||||||||

Ending Occupancy (2) | ||||||||||||||

| Consolidated | 97.4 | % | 97.3 | % | ||||||||||

| Unconsolidated | 98.3 | % | 98.2 | % | ||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs (2) | 97.4 | % | 97.4 | % | ||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs - Same Center (3) | 97.6 | % | 97.5 | % | ||||||||||

Average Tenant Sales Per Square Foot (2)(4) | ||||||||||||||

| Consolidated | $474 | $435 | ||||||||||||

| Unconsolidated | $486 | $459 | ||||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs (2) | $475 | $438 | ||||||||||||

Total Owned Properties including pro rata share of unconsolidated JVs - Same Center (5) | $472 | $441 | ||||||||||||

Occupancy Cost Ratio (2)(6) | 9.7 | % | 9.5 | % | ||||||||||

(1)Amounts may not recalculate due to the effect of rounding.

(2)September 2025 occupancy, average tenant sales per square foot, and occupancy cost ratio include the results of The Promenade at Chenal, Pinecrest, and Tanger Outlets Kansas City at Legends, which were acquired in the fourth quarter of 2024, the first quarter of 2025, and the third quarter of 2025, respectively, and exclude the center in Howell, Michigan that was sold in April 2025.

(3)Excludes the results of The Promenade at Chenal, Pinecrest, and Tanger Outlets Kansas City at Legends for September 2025 and the center in Howell, Michigan for September 2024.

(4)Average tenant sales per square foot is presented on a constant currency basis for the trailing twelve-month periods and include stores in stabilized centers that have been occupied a minimum of twelve months and are less than 20,000 square feet. Constant currency is a non-GAAP measure, calculated by applying the average foreign exchange rate for the current period to all periods presented.

(5)Excludes the results of The Promenade at Chenal, Pinecrest, Tanger Outlets Kansas City at Legends, and Tanger Outlets Nashville for September 2025 and the center in Howell, Michigan for September 2024.

(6)Occupancy cost ratio represents annualized occupancy costs as of the end of the reporting period as a percentage of tenant sales for the trailing twelve-month periods for consolidated properties and the Company’s pro rata share of unconsolidated joint ventures.

3

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

Geographic Diversification

As of September 30, 2025

Consolidated Properties

| State | # of Centers | GLA | % of GLA | ||||||||||||||

| South Carolina | 5 | 1,606,491 | 12 | % | |||||||||||||

| New York | 2 | 1,466,753 | 10 | % | |||||||||||||

| Alabama | 2 | 1,205,677 | 9 | % | |||||||||||||

| Georgia | 3 | 1,156,073 | 8 | % | |||||||||||||

| Pennsylvania | 3 | 999,442 | 7 | % | |||||||||||||

| Texas | 2 | 823,650 | 6 | % | |||||||||||||

| Tennessee | 2 | 740,746 | 5 | % | |||||||||||||

| North Carolina | 2 | 701,362 | 5 | % | |||||||||||||

| Kansas | 1 | 689,854 | 5 | % | |||||||||||||

| Ohio | 1 | 638,396 | 5 | % | |||||||||||||

| Delaware | 1 | 547,937 | 4 | % | |||||||||||||

| New Jersey | 1 | 484,748 | 3 | % | |||||||||||||

| Arizona | 1 | 410,753 | 3 | % | |||||||||||||

| Michigan | 1 | 357,133 | 3 | % | |||||||||||||

| Florida | 1 | 351,691 | 3 | % | |||||||||||||

| Missouri | 1 | 329,861 | 2 | % | |||||||||||||

| Mississippi | 1 | 325,831 | 2 | % | |||||||||||||

| Louisiana | 1 | 321,066 | 2 | % | |||||||||||||

| Connecticut | 1 | 311,229 | 2 | % | |||||||||||||

| Arkansas | 1 | 269,642 | 2 | % | |||||||||||||

| New Hampshire | 1 | 250,558 | 2 | % | |||||||||||||

| Total Consolidated Properties | 34 | 13,988,893 | 100 | % | |||||||||||||

| Unconsolidated Joint Venture Properties | |||||||||||||||||

| # of Centers | GLA | Ownership % | |||||||||||||||

| Charlotte, NC | 1 | 398,674 | 50 | % | |||||||||||||

| Ottawa, ON | 1 | 357,213 | 50 | % | |||||||||||||

| Columbus, OH | 1 | 355,245 | 50 | % | |||||||||||||

| Texas City, TX | 1 | 352,705 | 50 | % | |||||||||||||

| National Harbor, MD | 1 | 341,156 | 50 | % | |||||||||||||

| Cookstown, ON | 1 | 307,883 | 50 | % | |||||||||||||

| Total Unconsolidated Joint Venture Properties | 6 | 2,112,876 | |||||||||||||||

| Tanger’s Pro Rata Share of Unconsolidated Joint Venture Properties | 1,056,438 | ||||||||||||||||

| Managed Property | |||||||||||||||||

| # of Centers | GLA | ||||||||||||||||

| Palm Beach, FL | 1 | 457,326 | |||||||||||||||

| Total Owned and/or Managed Properties | 41 | 16,559,095 | |||||||||||||||

| Total Owned Properties including pro rata share of unconsolidated JVs | 40 | 15,045,331 | |||||||||||||||

4

Supplemental Operating and Financial Data for the

Quarter Ended September 30, 2025

Property Summary - Occupancy at End of Each Period Shown (1)

| Property Name | Location | Total GLA 9/30/2025 | % Occupied 9/30/2025 | % Occupied 6/30/2025 | % Occupied 9/30/2024 | |||||||||||||||||||||

| Tanger Outlets Deer Park | Deer Park, NY | 737,473 | 100.0 | % | 99.6 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Riverhead | Riverhead, NY | 729,280 | 94.8 | % | 95.6 | % | 95.6 | % | ||||||||||||||||||

| Tanger Outlets Kansas City at Legends | Kansas City, KS | 689,854 | 93.5 | % | N/A | N/A | ||||||||||||||||||||

| Bridge Street Town Centre, a Tanger Property | Huntsville, AL | 650,941 | 90.2 | % | 87.2 | % | 93.9 | % | ||||||||||||||||||

| Pinecrest, a Tanger Property | Cleveland, OH | 638,396 | 98.5 | % | 96.8 | % | N/A | |||||||||||||||||||

| Tanger Outlets Foley | Foley, AL | 554,736 | 96.9 | % | 96.0 | % | 96.8 | % | ||||||||||||||||||

| Tanger Outlets Rehoboth Beach | Rehoboth Beach, DE | 547,937 | 99.2 | % | 99.6 | % | 94.3 | % | ||||||||||||||||||

| Tanger Outlets Atlantic City | Atlantic City, NJ | 484,748 | 81.5 | % | 77.9 | % | 89.7 | % | ||||||||||||||||||

| Tanger Outlets San Marcos | San Marcos, TX | 471,816 | 99.3 | % | 99.3 | % | 97.5 | % | ||||||||||||||||||

| Tanger Outlets Savannah | Savannah, GA | 463,583 | 100.0 | % | 100.0 | % | 99.8 | % | ||||||||||||||||||

| Tanger Outlets Sevierville | Sevierville, TN | 450,079 | 97.3 | % | 95.6 | % | 98.3 | % | ||||||||||||||||||

| Tanger Outlets Myrtle Beach Hwy 501 | Myrtle Beach, SC | 426,523 | 97.6 | % | 94.8 | % | 98.9 | % | ||||||||||||||||||

| Tanger Outlets Phoenix | Glendale, AZ | 410,753 | 100.0 | % | 99.2 | % | 99.4 | % | ||||||||||||||||||

| Tanger Outlets Myrtle Beach Hwy 17 | Myrtle Beach, SC | 404,341 | 100.0 | % | 100.0 | % | 99.4 | % | ||||||||||||||||||

| Tanger Outlets Charleston | Charleston, SC | 386,328 | 100.0 | % | 99.8 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Asheville | Asheville, NC | 381,600 | 97.4 | % | 95.2 | % | 97.8 | % | ||||||||||||||||||

| Tanger Outlets Lancaster | Lancaster, PA | 375,883 | 98.7 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Pittsburgh | Pittsburgh, PA | 373,863 | 99.7 | % | 96.4 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Commerce | Commerce, GA | 371,408 | 100.0 | % | 100.0 | % | 96.3 | % | ||||||||||||||||||

| Tanger Outlets Grand Rapids | Grand Rapids, MI | 357,133 | 98.7 | % | 93.4 | % | 96.8 | % | ||||||||||||||||||

| Tanger Outlets Fort Worth | Fort Worth, TX | 351,834 | 99.1 | % | 98.3 | % | 97.8 | % | ||||||||||||||||||

| Tanger Outlets Daytona Beach | Daytona Beach, FL | 351,691 | 100.0 | % | 99.7 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Branson | Branson, MO | 329,861 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Memphis | Southaven, MS | 325,831 | 100.0 | % | 99.4 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Atlanta | Locust Grove, GA | 321,082 | 100.0 | % | 98.1 | % | 98.4 | % | ||||||||||||||||||

| Tanger Outlets Gonzales | Gonzales, LA | 321,066 | 95.8 | % | 94.4 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets Mebane | Mebane, NC | 319,762 | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||||||

| Tanger Outlets at Foxwoods | Mashantucket, CT | 311,229 | 97.2 | % | 94.8 | % | 90.6 | % | ||||||||||||||||||

| Tanger Outlets Nashville | Nashville, TN | 290,667 | 98.2 | % | 95.9 | % | 96.2 | % | ||||||||||||||||||

| The Promenade at Chenal, a Tanger Property | Little Rock, AR | 269,642 | 97.6 | % | 96.0 | % | N/A | |||||||||||||||||||

| Tanger Outlets Tilton | Tilton, NH | 250,558 | 95.3 | % | 94.4 | % | 98.0 | % | ||||||||||||||||||

| Tanger Outlets Hershey | Hershey, PA | 249,696 | 100.0 | % | 99.2 | % | 98.2 | % | ||||||||||||||||||

| Tanger Outlets Hilton Head II | Hilton Head, SC | 206,564 | 97.1 | % | 95.6 | % | 90.3 | % | ||||||||||||||||||